Vedanta, the Anil Agarwal-led mining entity, on Thursday declared an interim dividend of Rs 31.50 per share for the current financial year, amounting to Rs 11,710 crore.

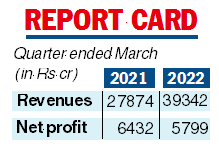

The company has reported an around 10 per cent fall in consolidated net profits for the quarter ended March 31. Net profits of Vedanta declined to Rs 5,799 crore from Rs 6,432 crore a year ago.

During the quarter, revenues rose to Rs 39,342 crore from Rs 27,874 crore in the year-ago period.

Vedanta said it paid Rs 45 per share as dividend in 2021-22, amounting to Rs 16,728 crore which translates into an around 14 per cent dividend yield.

It added that this amount was one of the highest among peers in the fiscal. On the board decision of declaring the first interim dividend of

Rs 31.50 for 2022-23, the company said this is line with its robust performance on profitability and cash flows.

“We have delivered historical best EBITDA (earnings before interest, tax, depreciation & amortisation) of Rs 45,319 crore and PAT (before exceptional and one-time tax credit) of Rs 24,299 crore in 2021-22,’’ Sunil Duggal, Vedanta CEO, said.

Seeks land

In a race to become India’s first chip maker, Vedanta has asked for 1,000 acres (405 hectares) of free land from states and other incentives for its $20 billion foray into semiconductor and display manufacturing, sources told Reuters.

The oil-to-metals conglomerate in February said it will diversify into chip manufacturing and announced plans to form a joint venture with Taiwan’s Foxconn.

(With inputs from Reuters)