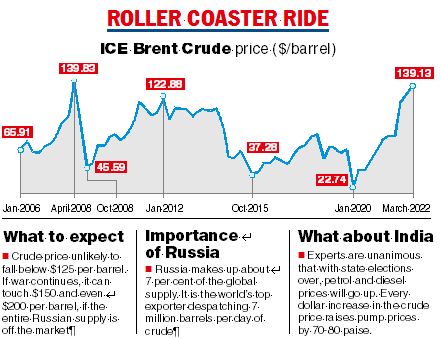

Oil prices spiked to their highest levels since 2008 on Monday amid market supply fears as the United States and European allies considered banning Russian oil imports and prospects for a swift return of Iranian crude to global markets receded.

Brent crude reached $139.13 a barrel and US West Texas Intermediate (WTI) hit $130.50 in early trade, both benchmarks striking their highest since April 2008 before paring the gains.

By 1437 GMT, Brent was up $3.54, or 3 per cent, at $121.65 per barrel and WTI up $1.93, or 1.7 per cent, at $117.61.

Global oil prices have spiked more than 60 per cent since the start of 2022, along with other commodities, raising concerns about world economic growth and stagflation. China, the world’s No. 2 economy, is already targeting slower growth of 5.5 per cent this year.

US secretary of state Antony Blinken said on Sunday the United States and European allies were exploring banning imports of Russian oil, while the White House was co-ordinating with Congressional committees to move forward with a US ban.

“We consider $125 per barrel, our near-term forecast for Brent crude oil, as a soft cap for prices, although prices could rise even higher should disruptions worsen or continue for a longer period,” UBS commodity analyst Giovanni Staunovo said.

A prolonged war could see Brent moving above the $150 per barrel mark, he said.

Analysts at Bank of America said if most of Russia’s oil exports were cut off, there could be a 5 million barrel per day (bpd) or larger shortfall, pushing prices as high as $200.

JP Morgan analysts said oil could soar to $185 this year, and analysts at Mitsubishi UFJ Financial Group Inc said oil may rise to $180 and cause a global recession.

Russia is the world’s top exporter of crude and oil products combined, with exports around 7 million bpd, or 7 per cent of global supply. Some volumes of Kazakhstan’s oil exports from Russian ports have also faced complications.

The head of Japan’s largest business lobby said the country’s imports of Russian crude could not be replaced immediately. Russia is Japan’s fifth-biggest supplier of crude oil and liquefied natural gas (LNG).

Meanwhile, talks to revive Iran’s 2015 nuclear deal with world powers were mired in uncertainty after Russia demanded a US guarantee that sanctions it faces over the Ukraine conflict would not hurt its trade with Tehran. China also raised new demands, sources said.

France told Russia on Monday not to resort to blackmail over efforts to revive the nuclear deal, while Iran’s top security official said the outlook for the talks “remains unclear”.

“Iran was the only real bearish factor hanging over the market but if now the Iranian deal gets delayed, we could get to tank bottoms a lot quicker especially if Russian barrels remain off the market for long,” said Amrita Sen, co-founder of Energy Aspects, a think tank.

Iran will take several months to restore oil flows even if it reaches a nuclear deal, analysts said.

Separately, US and Venezuelan officials discussed the possibility of easing oil sanctions on Venezuela but made scant progress toward a deal in their first high-level bilateral talks in years, five sources familiar with the matter said, as Washington seeks to separate Russia from one of its key allies.

Aramco price hike

Saudi Arabia’s state oil producer Aramco raised the April official selling prices for crude it sells to Asia by more than $2 a barrel, with some grades hitting all-time highs, as global markets struggled with Russian oil disruption.

Record Saudi crude prices come on the back of an expected rise in West Asian oil demand as surging spot premiums and freight rates put supplies from Europe, Africa and the Americas out of the reach of Asian countries. The world’s top oil exporter lifted its April OSP to Asia for its flagship Arab Light crude to $4.95 a barrel versus the average of DME Oman and Platts Dubai crude prices, up $2.15 from March, Saudi Aramco said late on Friday.

India impact

Retail pump rates in India are aligned to a price of $82-83 per barrel and they would certainly go up once elections end, industry officials said.

According to ballpark estimates, every $1 increase in crude price impacts retail rates by 70-80 paise.

Analysts said to cushion the impact of the price rise, the Centre could cut the excise duty and state-owned oil firms increase the prices in a phased manner.

Rating agency Icra said the current account deficit (CAD) is likely to widen $14-15 billion (0.4 per cent of GDP) for every $10 per barrel rise in the average price of the Indian crude basket.

If the price averages $130 per barrel in FY2023, the CAD will widen to 3.2 per cent of GDP, crossing 3 per cent for the first time in a decade.

(With inputs from Delhi bureau)