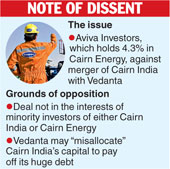

Mumbai, Aug. 6: Aviva Investors, part of insurer Aviva Plc, has opposed the merger of Cairn India with Vedanta Ltd, saying the deal is not in the interest of minority shareholders.

Aviva holds a 4.3 per cent stake in Edinburgh-based Cairn Energy plc, which owns around 10 per cent in Cairn India.

"As long-term investors, we believe the timing of this deal is opportunistic and materially undervalues Cairn India, its current reserves and future prospects," Aviva Investors said in a statement.

The statement added that in its current structure the deal failed to deliver value to minority shareholders and was not in the interests of minority investors of either Cairn India or Cairn Energy.

Aviva also said there was "a risk of the Vedanta Group misallocating capital" of oil producer Cairn India to pay off its huge debt.

"With high levels of debt and an aggressive capital expenditure programme, we fear Vedanta Group will prioritise its immediate needs over the long-term potential we believe exists at Cairn India."

Responding to Aviva's views, Vedanta said the value proposition continued to remain intact.

"The oil price fall only underlines the benefit of having a diversified portfolio of large, well-invested, long-life and low-cost assets. Synergies from the merger will accrue to all shareholders and will continue to allocate capital in the most efficient way to maximise value," Vedanta said.

It said that the vote on the merger would take place in the last quarter of this year and till then, the company would continue to engage with all shareholders.

Aviva's asset management business, Aviva Investors, provides asset management services to both Aviva and external clients and manages over £245 billion in assets.

Local JV stake

Aviva Plc today said it planned to increase stake in its life insurance venture in India to 49 per cent.

Aviva India is a joint venture between Dabur Invest Corp and Aviva, with the latter now holding a 26 per cent stake.

"The increase of foreign direct investment limits in India from 26 per cent to 49 per cent has made the Indian insurance market much more attractive. We intend to increase our stake in the Aviva India joint venture business. We are finalising our application to do this and expect to complete within the next six months," David McMillan, CEO of Aviva Europe and India, said.