A 72-year-old resident of Gariahat was duped of more than ₹27 lakh by a man who posed as a bank official over the phone.

Subhra Roy, who lives on Ekdalia Road, received a call last week from a person claiming to be a bank official.

The caller told her that the “know your customer” (KYC) documents linked to her husband’s pension account needed to be updated and asked for her banking details.

“Falling into the trap, the septuagenarian divulged her bank details along with an OTP that was generated in her phone. The fraudster directly accessed her bank account and liquidated a fixed deposit of ₹27 lakh and also transferred ₹75,000 from her savings account,” said an officer of the south east division.

When she received text messages about money being debited from her bank account, she realised that she had been duped.

The elderly woman reported the matter to Gariahat police station on Monday.

Police said a case has been registered under sections of cheating, criminal breach of trust, impersonation and criminal conspiracy.

No one was arrested till Tuesday evening.

The elderly couple live alone in their south Calcutta home, while their daughters reside abroad.

Police said many senior citizens living alone in the city are vulnerable to such frauds.

In this case, officers said the fear of losing her husband’s pension account prompted the elderly woman to share sensitive details without realising the consequences.

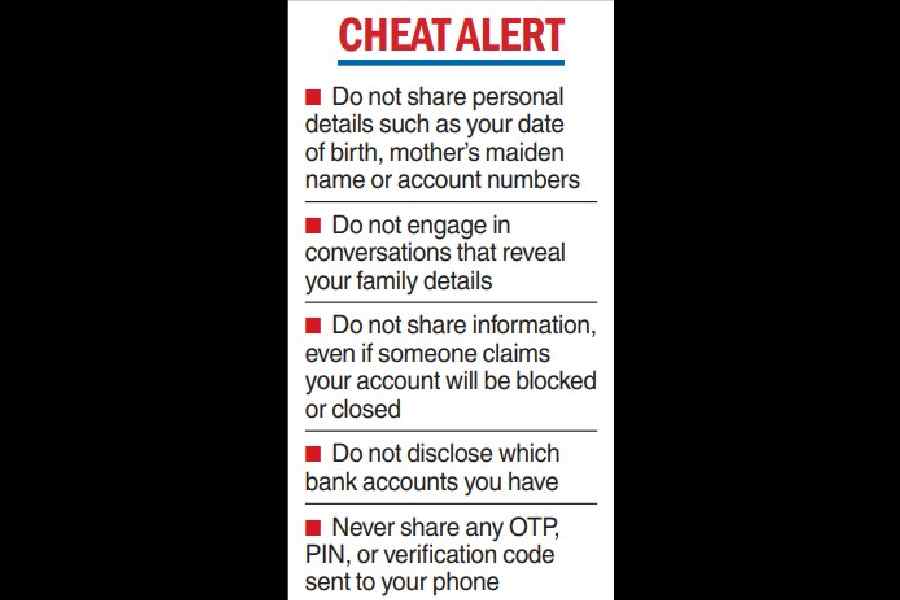

A senior police officer of the cyber cell of Kolkata Police said: “The biggest challenge is to make people realise that they should not share any OTP even if there is a fear of a bank account being closed or frozen.”

“In a majority of the cases, we have seen that the elderly fail to differentiate a genuine call from a fake one,” he added.

Many similar cases are reported to the police, where the greed to claim a lottery prize one has never won or to claim a loan which had never been sanctioned leads to a cybercrime trap.