Economic growth underpins human progress. Yet the West, which underwrote much of global prosperity since the Industrial Revolution, now seems unable to sustain it. Europe has struggled to regain its dynamism. The United States of America, still dominant through innovation and productivity, has seen its share of global output plateau. Among emerging economies, China remains the great success story, having transformed itself into the factory of the world and now leading in electric mobility and Artificial Intelligence. Yet its expansion, built on debt and infrastructure, faces limits of an ageing population and faltering demand. Beyond these giants, the regions most likely to sustain long-term growth of around 7%, capable of doubling their economies every decade, are India and Africa. That may be the defining economic story of our lifetimes.

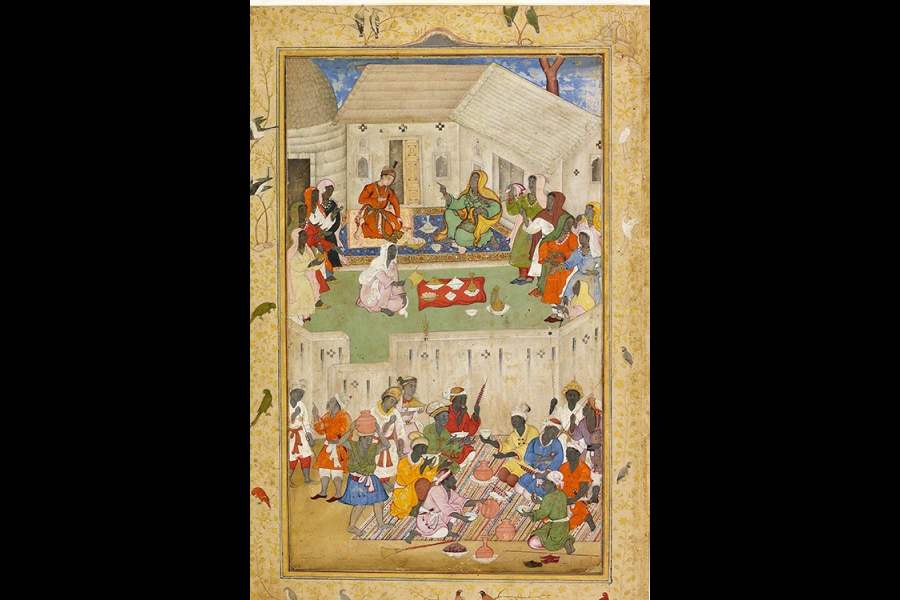

India shares a deep and enduring bond with Africa that stretches back centuries. Across the continent, Indian-origin hoteliers, bankers, grocers, and doctors are integral to the civic fabric. When M.K. Gandhi lived in South Africa, he conceived the idea of non-violent resistance that became the moral compass of India’s freedom struggle. Our solidarity with African liberation movements transformed a shared experience of subjugation into one of purpose. We were the first nation to cut diplomatic ties with

apartheid South Africa, seeing it as incompatible with our own quest for dignity. Today, we face a common challenge in overcoming poverty and inequality. In the decades ahead, our moral kinship could deepen into economic partnership.

By 2050, demography will rekindle opportunity. Africa has long struggled with sparse population density, but better health and political stability are changing that. Together, we will house more than 3.5 billion people, half under twenty-five. This shared youth bulge will form the world’s most dynamic market for housing, healthcare, education, food, and energy. If we stay the course, Africa could become our most consequential partner. By 2040, our GDP is projected to exceed $20 trillion and Africa’s more than $10 trillion, together forming an economy larger than the US today. Trade between our regions now stands near $100 billion, about 5% of Africa’s total. Even maintaining that share as both economies expand could lift bilateral flows beyond $600 billion by 2040. But if we deepen integration and raise our share to 25%, exchange could approach $2 trillion, reflecting the scale of opportunity.

To realise this, we must move beyond commodity exports and State-led projects toward collaboration in consumer goods, healthcare, education, and technology. Our firms are well placed to lead. Hindustan Unilever’s strategy of ‘Winning in Many Indias’, treating every region as a distinct market with tailored pricing, distribution, and communication, offers a playbook for Africa’s diversity. Indian businesses have learnt to thrive amid divergent buying power, segmented tastes, dialects, and cultural habits, understanding that detergent, tea or cosmetics must speak in the idiom of each region. This balance of aspiration and affordability is our differentiator. Africa’s multiplicity of nations and cultures mirrors our own complexity, making our firms uniquely prepared to succeed.

The adaptability of Indian business families is another strength, rooted in ambition, patience, and resilience. Across the continent, Indian-origin entrepreneurs have built formidable enterprises that embody this ethos. Ashish Thakkar, whose family once fled Idi Amin’s Uganda, built the Mara Group into a pan-African conglomerate spanning technology, finance, and manufacturing, from smartphones in Rwanda to fintech in Kenya. Manu Chandaria transformed the Comcraft Group from a small family workshop into an industrial empire across 40 countries. Sunil Vaswani, born in Jaipur, expanded the Stallion Group into one of Africa’s largest automobile, food, and steel companies. Prateek Suri, the founder of Maser Group, supplies affordable smart televisions across Africa. Such entrepreneurs are the most enduring bridge between our two regions.

As African cities expand, the demand for affordable infrastructure will surge. Rwanda’s clean, efficient, and business-friendly capital, Kigali, shows how good governance can turn urban reform into a national asset. Inclusive urbanisation must also address slums, transforming them into productive neighbourhoods where high-end and low-cost housing coexist in dignity. Africa’s housing deficit of more than 50 million units underscores the scale of the challenge. Indian firms are well-equipped to meet this need, drawing on expertise in modular housing, rooftop solar, and off-grid sanitation. India can also learn from Africa’s conservation ethos, seen in the eco-friendly tourism and community stewardship of the Masai Mara, Serengeti, and Virunga parks. Joint research and public-health initiatives could develop new responses to shared challenges such as malaria and dengue. Indian pharmaceutical companies already supply over 20% of Africa’s generics, while hospital groups such as Apollo, Narayana Health, and Fortis are establishing facilities across the region. Our ability to deliver world-class care at accessible costs can transform medical access across the continent. Education, too, will be central to this partnership. Indian schools and vocational institutes are opening campuses in Africa, meeting the aspirations of a rising middle class seeking English-medium education, STEM training, and affordable global pathways. Our experience in building scalable, high-quality institutions — from IITs and IIMs to NLS and NIFTs — offers a model for shared growth in human capital.

Financing this growth will demand long-term commitment. India’s EXIM Bank has extended about $12 billion in sovereign credit to Africa, a fraction of what China or Western lenders have deployed. Yet the potential runs far deeper. Our stock market is among the world’s fastest growing, and listing African businesses in BSE would anchor ventures in a shared ecosystem of governance, visibility, and value creation. An expanding base of family offices, venture capital, and private-equity funds can become a powerful engine for South-South investment. A dedicated India-Africa Growth Fund, co-supported by the government and leading Indian investors, could finance SMEs across manufacturing, retail, logistics, and healthcare.

In her recent book, Africonomics, Bronwen Everill challenges the long-standing Western habit of viewing African markets through the lenses of extraction, charity, or risk management. Our perspective, shaped by a shared history, is different: we see value not in control but in participation, not through aid but through enterprise. Indentured Indians joined enslaved Africans to forge Creole music that stands as a testament to our endurance. Today, the youth of our societies, rooted in culture yet open to the world, are breaking new ground in creative collaboration. El Anatsui’s shimmering metal tapestries and Yinka Shonibare’s reimagining of colonial identity have placed African creativity at the centre of the global art world, commanding attention at Frieze London 2025 and beyond. These cultural currents continue to enrich everyday life. Growing up in 1980s Calcutta, the Nigerian footballer, Chima Okorie, became India’s first foreign sports superstar long before the IPL and the ISL made international players household names for Indian children. Bollywood films play to packed halls in Lagos and Dar es Salaam, and the ties between our continents continue to deepen, reminding us that India and Africa share the essence of friendship, not the calculus of political alignment.

Yet friendship alone is not enough. We must now translate cultural empathy into strategic presence. China’s dominance across Africa shows how swiftly alignments can be redrawn. Gulf powers such as the United Arab Emirates, Qatar, and Turkey are following suit, and even the Netherlands maintains more embassies in Africa than we do. To keep pace, India must match ambition with sustained institutional focus on Africa’s growth. The opportunities are vast, but so too are the challenges.

Modern humans emerged in Africa and journeyed to India. The exchange of man and myth between our continents is as ancient as civilisation itself. In the century ahead, the story of prosperity may once again be written across these shores.

Rudra Chatterjee is Chairman of Obeetee, Managing Director of Luxmi Tea, and writes on finance and economic issues