The Telegraph

Arundhati on board

Former SBI chairperson Arundhati Bhattacharya has joined the board of Wipro as an independent director for a term of five years, with effect from January 1, 2019, the company said on Wednesday.

The development comes within days after Reliance Industries appointed Bhattacharya on its board as independent additional director.

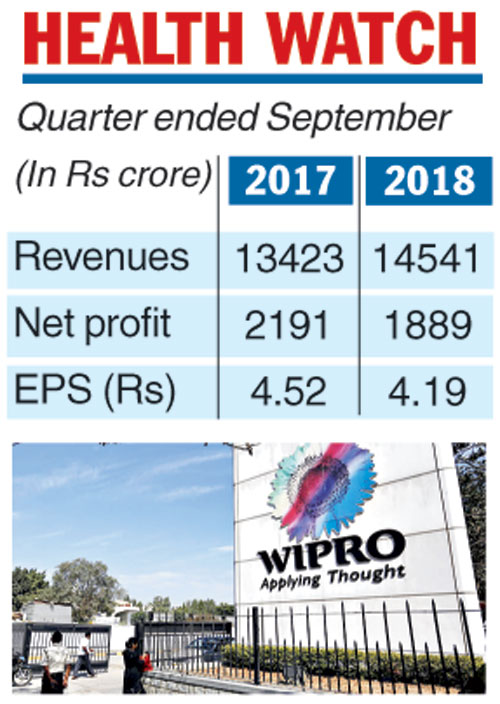

Wipro on Wednesday missed Street estimates for the September quarter when net profits dropped 14 per cent to Rs 1,889 crore compared with Rs 2,192 crore in the same period of last year.

Analysts had expected the firm to report net profits of around Rs 2,000 crore.

The disappointment in its bottomline came after operating margins in IT services fell to 14.6 per cent during the quarter against 17.2 per cent in the preceding three months.

Wipro said the IT services margin for the quarter included a loss of Rs 514 crore because of a settlement with one of its key customers. Adjusted for this settlement, its operating margin was 18.1 per cent.

During the quarter, Wipro’s dollar revenues from IT services came in at $2041.2 million. This was towards the upper end of the guidance that was given after the company declared its first-quarter numbers. Wipro had then forecast revenue from IT services to be in the range of $2,009-2,049 million. For the third quarter, the company expects revenues to be in the range of $2,028 million to $2,068 million.

“Wipro has delivered a strong quarter on both revenue and margin growth. We won our largest deal to date and four of our business units grew over 4 per cent sequentially in constant currency terms. The demand environment is robust, especially for digital transformation and enterprise scale modernisation services,’’ Abidali Z. Neemuchwala, CEO and member of the board, said.

During the quarter, the banking, financial services and insurance verticals continued its good performance and clocked a 3.4 per cent growth on a sequential basis. Communications, consumer business unit and energy & utilities also contributed by posting growth rates of 2.1 per cent, 3.7 per cent and 2.2 per cent, respectively. However, growth in the healthcare segment showed a fall of 3.2 per cent.