Mumbai, July 22: Vedanta has offered to sweeten the terms to take over subsidiary Cairn India after an initial bid had been stymied for a year.

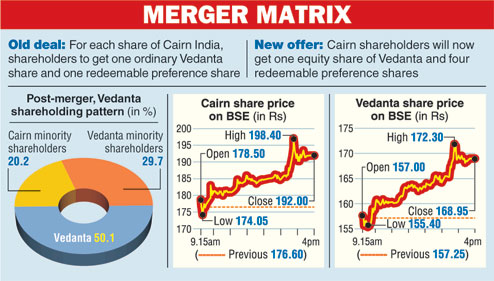

Vedanta will now give one share and four redeemable preference shares for each share in Cairn India, the company controlled by mining and metals tycoon Anil Agarwal said in a statement on Friday.

Earlier, it was offering one share and one redeemable preference share for each Cairn share. The preference shares will carry a coupon of 7.5 per cent and a tenure of 18 months.

The deal will give debt-ridden Vedanta access to oil and gas explorer Cairn India's $3.5-billion cash pile.

However, the merger can happen only if the income-tax department lifts its freeze on erstwhile parent Cairn Energy's 9.82 per cent stake in Cairn India.

The department had frozen the shares in pursuit of a Rs 29,000-crore tax demand on alleged capital gains made by Cairn Energy in 2006 when it transferred its India business into new subsidiary Cairn India and listed it on the bourses.

Cairn Energy sold its majority stake in Cairn India to Vedanta in 2011 but retained a minority shareholding.

Also LIC, which holds 9.06 per cent in Cairn India, has to come on board. The insurer was opposed to the deal in the form it was proposed in June last year.

Besides, half of the minority shareholders holding 40 per cent of Cairn India's equity have to approve the deal.

The income tax department had previously said the freeze on Cairn Energy shares could be lifted on the receipt of collateral equivalent to the market value of the shares.

Vedanta and Cairn India will seek the minority vote in shareholder meetings convened on September 8 for Vedanta and September 12 for Cairn.

Senior officials hinted that Cairn Energy would be allowed to vote on the merger and that their ability to vote would not be hindered by the retrospective tax claim. LIC and Cairn Energy declined to comment on the new offer on Friday.

Anil Agarwal, chairman of Vedanta Resources, said: "The simplified corporate structure will better align interests between all shareholders for the creation of long term sustainable value."

Tom Albanese, CEO of Vedanta, said shareholders of Cairn India will gain from the cost saving in the metal and mining business. He pointed out that the cost of the debt for the merged entity would also come down by at least 1 per cent.

The new terms give a premium of 20 per cent to the volume-weighted average price of Cairn India's stock price over the past month, Vedanta said.

"The revised terms seem more attractive than (the offer) in the past," said Jigar Shah, chief executive at Maybank Kimeng Securities.

Cairn India shares ended 8.5 per cent higher at Rs 191.90 on the BSE, while Vedanta closed with a gain of 7.8 per cent at Rs 169.30.

Post-merger, parent Vedanta Resources' holding in Vedanta will drop to 50.1 per cent from 62.9 per cent. Cairn India's minority shareholders will own 20.2 per cent and Vedanta minority shareholders 29.7 per cent.