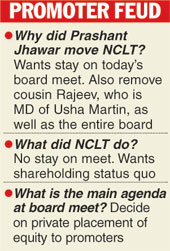

Calcutta, Aug. 18: The power struggle within the Jhawar family, owner of wire and wire rope maker Usha Martin Ltd, came out in the open again with Prashant Jhawar moving the National Company Law Tribunal to remove cousin brother Rajeev Jhawar from the post of managing director and supersede the entire board, alleging mismanagement.

The immediate provocation to this latest bout is a board meeting slated tomorrow to consider raising equity capital by private placement to the promoters. Prashant and his father Basant K. Jhawar wanted stay on the meeting.

After hearing the matter at length, the NCLT bench of judicial member Vijay Pratap Singh and K R Jinan, technical member, did not pass any order to stay the board meeting or any resolution or agenda to be taken up at the meeting but asked the parties to maintain status quo with respect to the shareholding in the company.

The bench directed the parties to file their replies and fixed the petition for hearing on September 14.

Today's court move follows the unceremonious exit of Prashant Jhawar on April 25 when the lead lender to the company, the State Bank of India, brought a resolution to strip him from the position of the chairman of Usha Martin Limited and installed former Sebi chairman Ghyanendra Nath Bajpai, an independent director on the board, as chairman.

All the non-promoter board member backed the resolution then. Prashant Jhawar was then accused of not pledging his share as part of a loan covenant despite repeated assurance and also scuppering the sale process initiated for the wire and wire rope division. The relief made by Prashant Jhawar before the NCLT today sought an order declaring his removal as illegal and reinstate him.

Board meet

Tomorrow's board meet to approve infusing Rs 90 crore equity through convertible preferential warrants is also at the instance of the lenders.

When the SBI sanctioned a term loan of Rs 290 crore and a corporate loan of Rs 900 crore on December 8, 2015, one of the conditions was the arrangement of additional funds by the promoters.

"The resolution proposed at the board meeting tomorrow does not alter any shareholding of the parties and is only a proposal to allot shares to the promoters and promoter group entities which will include not only Rajeev Jhawar entities but also Prashant Jhawar entities," Debanjan Mandal, partner of Fox & Mandal, the solicitor for Usha Martin Limited, noted.

The promoter shareholding in UML stood at 50.85 per cent at the end of June quarter. It is believed that the shares are equally divided among Prashant Jhawar-Basant K Jhawar and Rajeev Jhawar- Braj Kishore Jhawar.

Incidentally, the capital infusion proposal, if passed by the board tomorrow, has to be approved by the shareholders with a two-third majority. There is a possibility that the Prashant Jhawar-faction may be able to block the resolution.

Each warrant is to be converted to one equity share of face value Re 1 within 18 months from the date of the issue at a price to be determined later.

Sources said Prashant Jhawar was unwilling to put fresh capital in Usha Martin Limited which is being managed by his cousin and where he has little control over the day-to-day affairs.

Rajeev Jhawar declined to comment before the board meet. An email sent to Prashant Jhawar did not elicit response till going to the press. The Usha Martin stock closed down 2.31 per cent, or Rs 0.45, to close at Rs 19 on the BSE today.