Mumbai, June 23: A consortium of lenders, led by Punjab National Bank (PNB), today decided to refer Bhushan Power & Steel to the National Company Law Tribunal (NCLT) for insolvency proceedings.

This comes a day after banks led by the State Bank of India (SBI) decided to commence insolvency proceedings against Bhushan Steel, Essar Steel and Electrosteel Steels by referring them to the NCLT under the Insolvency and Bankruptcy Code (IBC).

In a letter to the bourses today, Bhushan Steel said the lenders' consortium had authorised the SBI to refer the company to NCLT.

While Bhushan Steel has an outstanding debt of around Rs 45,000 crore, Bhushan Power has a debt of a little over Rs 37,000 crore. In the case of the latter, the lead lender is Punjab National Bank (PNB).

An internal committee of the Reserve Bank of India (RBI) had picked 12 large accounts that would come under bankruptcy proceedings.

So far, banks have decided to send eight cases to the NCLT. Such cases will be accorded priority by the NCLT, which would be the adjudicating authority on cases that come under the code.

The IBC sets a deadline of 180 days to decide the fate of a company that defaults.

If 75 per cent of the creditors agree on a revival plan, that term can be extended by 90 days. Else a firm would be automatically liquidated.

Amtek Auto

The board of Amtek Auto today discussed ways to resolve debt repayment issues as the components maker faced prospects of falling under the IBC.

The company added that vice-chairman and managing director John Ernest Flintham and independent and non-executive director Sanjiv Bhasin had resigned with immediate effect citing "unavoidable circumstances".

In a filing to the bourses, Amtek Auto said the board of directors had discussed the issue of the company falling under the IBC, 2016 under instructions by the RBI to the banks.

The company had last week announced plans to issue more than 2.6 crore shares to a lender as part of a plan to restructure debt of Rs 95.26 crore.

The firm will seek shareholders nod for the proposal during the upcoming annual general meeting (AGM) on July 7.

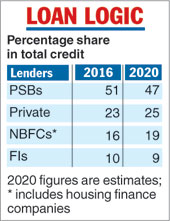

While bad loans in the banking system is estimated at Rs 8 trillion, bulk of these are in the books of the PSU lenders.