When Shaktikanta Das walks into the 18th floor corner office of the Reserve Bank of India (RBI) headquarters on Mint Road, the slowdown in India’s GDP growth will not be the only factor confronting him. Das will be facing more daunting tasks — meeting expectations of the Union government while not giving up the autonomy of the central bank.

It is this delicate balancing act which will now be watched intensely by investors and markets not only in India but overseas as well.

To begin with, there could be some good news. Experts feel that the markets may react positively on Wednesday to his appointment because of the feeling that it could lead to the end of hostilities with the Union government on various issues.

His entry could also see shadow banks and those starved of liquidity getting some more relief from the central bank. The availability of liquidity to non-banking finance companies (NBFCs) and some sections of the industry, including MSMEs, was one of the key points of difference between the RBI and the Centre.

At the post policy press conference last week, deputy governor Viral Acharya had said that though the central bank was ready to act as a lender of last resort to NBFCs, there was no necessity for the RBI to do so at present.

The RBI had already taken various measures to ease liquidity over the past few months. It remains to be seen if the RBI under Das revisits this decision.

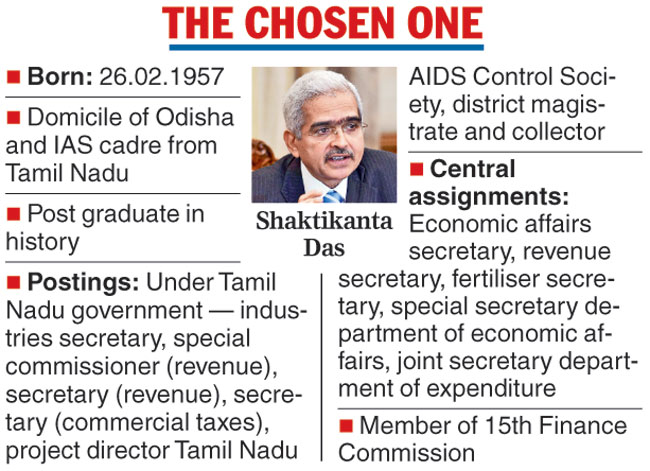

While observers point out that Das comes with strong credentials, they do admit that maintaining the independence of the RBI, particularly in the context of Urjit Patel’s resignation, will be his main challenge.

“He (Das) is a bureaucrat with an excellent track record, but he is now in ‘Caesar’s wife’ situation. He should not only be above suspicion but also present himself like that. He has to make that extra effort to ensure that he is not perceived as the government’s ‘yes’ man. That is his main challenge. He is a very competent officer and comes with an excellent track record. Apart from solving the issues that the government has raised, and manning the economy, his additional challenge will be to maintain the perception that he is not the government’s man in the RBI,’’ Sudip Bandyopadhyay, group chairman at Inditrade Capital, told The Telegraph.

Experts here recollect the famous words of former RBI governor Duvvuri Subbarao (also an IAS officer) who told a television channel two years ago in an interview that when he took the flight from the nation’s capital to Mumbai (to don the RBI governor’s hat after resigning as finance secretary), he became an “RBI man” mid air. It remains to be seen if Das is able to do the same.

While there are a few who feel that the government should have appointed an economist instead of a bureaucrat at the RBI, there are others who are optimistic.

“He will fit the bill perfectly. His appointment will take away all the uneasiness that we have seen over the last few weeks and Das will be more conscious of the needs of the government and industry. He comes at a time when globally there is a slowdown. While India is one of the few economies that have a higher growth rate, we need more impetus on growth, which Das will be able to provide,’’ Sanjiv Bhasin, executive VP — markets and corporate affairs, said.

Industry already has its wish list ready. The CII on Tuesday said the appointment of the former bureaucrat as the new RBI governor will come as a huge sentiment booster for industry and expressed its confidence that he will take urgent steps to address the liquidity squeeze in the economy.

While the RBI had refrained from cutting the cash reserve ratio (CRR), it has to be seen if this is brought down in the new regime headed by Das.

The Telegraph