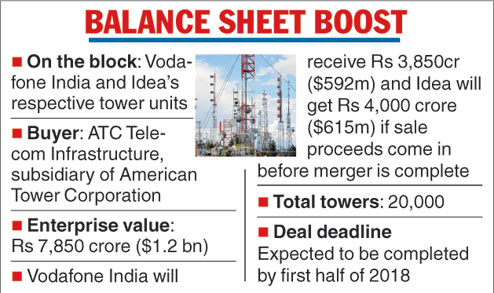

Mumbai: Vodafone India and Idea Cellular are selling their respective tower businesses in the country to ATC Telecom Infrastructure (ATC TIPL) for an aggregate enterprise value of Rs 7,850 crore ($1.2 billion).

The two entities together own 20,000 towers and the deal is expected to be completed by the first half of 2018. ATC TIPL is a subsidiary of American Tower Corporation.

The transaction will see the AV Birla group firm selling its entire holding in Idea Cellular Infrastructure Services Ltd (ICISL), while Vodafone will divest its business undertaking to ATC Infra.

"In the event that the completion of the sale of the standalone tower businesses precedes the completion of the proposed merger of Vodafone India and Idea, Vodafone India will receive Rs 3,850 crore ($592 million) and Idea Cellular will receive Rs 4,000 crore ($615 million)," a joint press statement said.

The companies had anticipated that the proceeds from the tower sale might come in prior to the completion of the merger and had provided for this in the merger agreement.

The sale will not affect the agreed terms of the merger, including the amount of debt that Vodafone will contribute to the combined company at completion. Further, both Vodafone India and Idea Cellular as customers, and ATC TIPL as a mobile network infrastructure provider, have agreed to treat each other as long-term preferred partners, subject to existing arrangements.

After Vodafone India and Idea Cellular complete their merger, 6,300 co-located tenancies of the two operators on the combined standalone tower businesses will form single tenancies over two years.

The sale of the tower business is subject to regulatory and other approvals.

Earlier this year, Vodafone India and Idea had agreed to merge their operations to create the country's largest telecom operator with a 35 per cent market share.

The companies had then announced their intention to sell their individual standalone tower businesses to strengthen the balance sheet of the combined business.

Idea loss

Net losses at Idea Cellular on a standalone basis widened to Rs 1,176 crore for the quarter ended September 30 compared with Rs 617 crore in the preceding three months and a profit of Rs 43 crore in the same period of last year. Total revenues of the telecom company declined to Rs 7,465 crore from Rs 8,167 crore in the first quarter and Rs 9,300 crore in the year-ago period.

Idea Cellular said the operating environment remained challenging with unrelenting pressure on pricing, the introduction of the GST (at 18 per cent compared with a service tax of 15 per cent) and a need for large investments to support the rising data demand.

The company added that while there was the seasonal industry slowdown during the quarter, impact on its subscribers and revenue loss was more pronounced because of the higher share of rural subscribers.

Shares of Idea Cellular ended with losses of 3.61 per cent at Rs 93.55 on the Bombay Stock Exchange.