The board of Jet Airways will meet on Thursday to consider the third-quarter results amid a buzz that the crisis-hit airline may announce cash infusion by lenders, led by the State Bank of India (SBI).

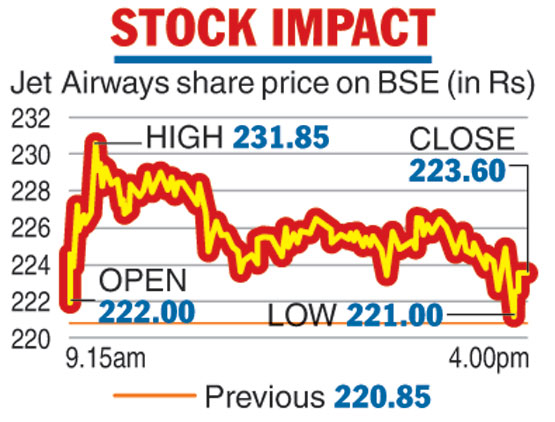

Optimism on this front saw the Jet stock ending with gains of 1.25 per cent at Rs 223.60 on the BSE on Wednesday. The green tick in the counter came on a day the benchmark Sensex finished lower by almost 120 points at 36034.11. Meanwhile, Bloomberg reported that the airline may get an emergency loan of around Rs 600 crore to help it overcome the cash crunch.

Earlier this month, the airline had disclosed that four of its aircraft have been grounded over the non-payment of lease rentals. The company had then said it was engaged with all its aircraft lessors and was providing them with regular updates on efforts undertaken to improve its liquidity. It is also providing updates to the DGCA on the schedule of flights to be operated. The Jet Airways group has a fleet of 124 planes, including Boeing 777-300 ERs, Airbus A330-200/300 and ATR 72-500/600s.

During the second quarter of this year, Jet Airways had reported its third straight quarterly loss with the standalone net loss coming in at Rs 1,297.46 crore compared with a profit of Rs 49.63 crore in the same period last year. During the April-June 2018 period, it had posted a loss of Rs 1,323 crore.

The airline owes over Rs 8,000 crore to the banks, led by the SBI. It will be holding an extraordinary general meeting (EGM) on February 21 where it will seek shareholders’ approval to convert existing debt into equity.

Jet Airways told shareholders in the EGM notice that loans received in the future may also be converted into equity. After the conversion of debt into equity, the SBI will reportedly hold 15 per cent in the airline.

At present, Etihad holds 24 per cent in the airline. However, the Abu Dhabi-based carrier had earlier told the lenders that it was willing to infuse more capital, but had set tough conditions one of which includes an exemption from making an open offer.

The Telegraph