Taiwanese chip maker TSMC cut its annual investment budget by at least 10 per cent for 2022 and struck a more cautious note than usual on upcoming demand, flagging challenges from rising inflationary costs and predicting a chip downturn next year.

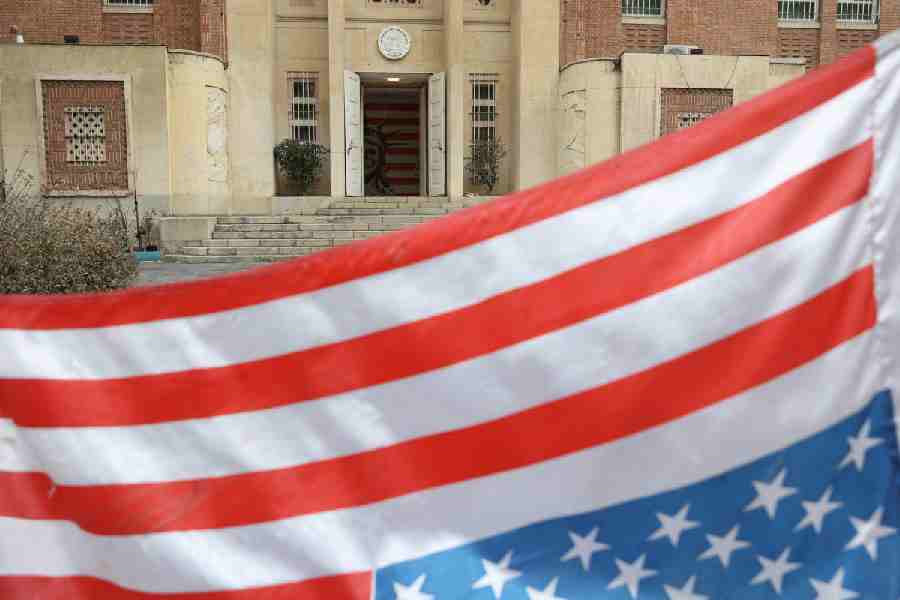

Speaking on the latest set of US export controls aimed at slowing China’s progress in advanced chip manufacturing, TSMC CEO C.C. Wei said on Thursday that it had obtained a one-year authorisation that covered its factory in Nanjing, China.

The new rules require firms looking to supply Chinese chipmakers with advanced gear to obtain a licence from the US Department of Commerce, though Washington is expected to spare some foreign firms operating in China.

“Based on our initial reading and feedback from customers the new regulations sets the control threshold at a very high-end specification, primarily used for AI or supercomputing applications. Therefore, our initial assessment is the impact to TSMC is limited and manageable,” Wei said.

Taiwan Semiconductor Manufacturing Co Ltd (TSMC), the world’s largest contract chip maker, makes most of its chips in Taiwan.

After posting an 80 per cent surge in third-quarter profit, the strongest growth in two years, TSMC said it was being more conservative in planning investments for 2023.

“We expect probably in2023 the semiconductor industry will likely decline, but TSMC also is not immune,” Wei told a media call.

TSMC’s dominance in making some of the world’s most advanced chips for high-end customers such as Apple Incand Qualcomm Inc had shielded it from the downturn flagged by chipmakers, including AMDand Micron Technology Inc.

TSMC’s commentary on Thursday, though, was more in line with industry concerns about decades-high inflation, rising interest rates and Covid19 lockdowns in China that have squeezed the consumer electronics market.