Pressure on all sectors

“Despite the government's decisive move about IL&FS, the markets are under relentless pressure on the back of crude oil touching multi-year highs and the rupee making fresh all-time lows. The precarious positioning of international macros is simply not letting the pressure off the market. The last-man-standing industries such as large cap autos and IT have also started melting, almost leaving no place for markets to hide,” Jagannadham Thunuguntla, senior VP and head of research (wealth), Centrum Broking said.

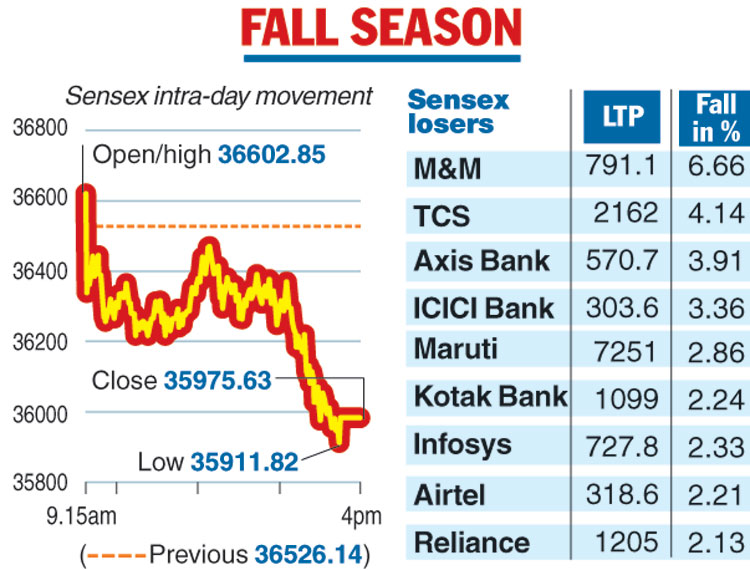

In the Sensex pack, M&M was the biggest loser, as it fell by 6.66 per cent, followed by TCS 4.14 per cent. The other counters that ended in the red included Axis Bank, ICICI Bank, Maruti Suzuki and Kotak Mahindra Bank. However, Yes Bank continued its recovery for the second straight session and emerged top gainer by rising 5.79 per cent. Among sectoral indices, the BSE auto index emerged the worst performer by falling 2.90 per cent, followed by tech shedding 2.38 per cent, IT 2.23 per cent and bankex 1.54 per cent, FMCG 1.17 per cent, consumer durables 0.83 per cent, power 0.48 per cent and healthcare 0.38 per cent.

Investor wealth was eroded by Rs 1.71 lakh crore and the benchmark Sensex tumbled over 550 points on Wednesday as stocks were roiled by the deadly cocktail of rising crude oil prices and a falling rupee. There was no good news at the bond markets either with the yields on the benchmark 10-year government bond closing higher at 8.11 per cent.

The Sensex slipped below 36000 amid heavy selling in IT, auto and telecom stocks. This came after the rupee fell to a new low on rising crude oil prices.

The benchmark 30-share index opened in the green at 36602 and remained above this level but came under intense selling pressure towards the last hour of the trade. It fell below the 36000-mark to a low of 35911.82. The Sensex finally settled 550.51 points, or 1.51 per cent, lower at 35975.63. The gauge had gained 299 points in the previous session after the Reserve Bank of India (RBI) announced measures to shore up liquidity.

The broader Nifty on the NSE, too, remained in the negative zone through the session and hit a low of 10843.75. It later finished lower by 150.05 points, or 1.36 per cent, at 10858.25.

The fall in shares was blamed on firm crude oil prices and the depreciating rupee. Market circles said the upcoming monetary policy also kept many investors in the sidelines.

A 25-basis-point hike in the policy repo rate has been factored in by the Street, and the focus is on whether the central bank will change its stance from neutral and whether it will announce any fresh steps to protect the rupee or improve the liquidity in the banking system.

The Telegraph