Mumbai, May 4: The Sensex today soared 479 points to settle at 27490.59 on across-the-board buying led by auto, realty and refinery stocks as investors took fresh positions after persistent selling in April. Moreover, the 50-share NSE Nifty rose 150 points to regain the 8300-level.

Across-the-board buying at the beginning of the May series, rallies in refinery stocks and the passing of Finance Bill, 2015 boosted sentiments, brokers said.

Meanwhile, the BSE market capitalisation regained the Rs 100 lakh crore-level, helped by robust gains in ONGC, RIL and Infosys.

Amid persistent taxation concerns faced by foreign investors, the indices had hit near four-month low in the last trading session on Thursday.

Finance minister Arun Jaitley in Parliament on Thursday clarified that minimum alternate tax (MAT) will not apply to capital gains on the sale of securities, royalty, technical service fees and interest income.

Brokers also attributed today's rebound to value-buying from an "over-sold" position after persistent fall in stock prices in the April series as participants snapped up recently beaten down blue-chip stocks.

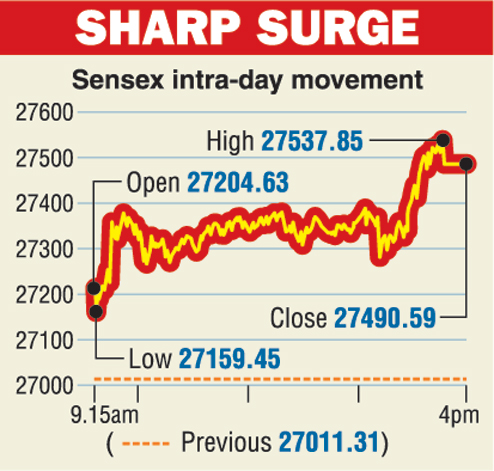

The Sensex resumed higher at 27204.63 and shot up to a high of 27537.85 before ending at 27490.59, registering a rise of 479.28 points, or 1.77 per cent.

The 50-share NSE Nifty recaptured the 8300-level to hit a high of 8346.00 points, before settling 150.45 points, or 1.84 per cent higher at 8331.95. This is the best single-day gain in two months for the index.

Overseas, European stocks were trading higher after latest data showed that euro zone's manufacturing sector expanded in April. Key indices in France and Germany rose in the range 0.39 to 0.84 per cent, while the UK market was closed today.

Meanwhile, foreign portfolio investors (FPIs) sold shares worth Rs 3,157.61 crore and domestic institutional investors bought shares worth Rs 2,460.80 crore on Thursday, according to provisional data.

Asian stocks ended mixed as weak China factory activity reinforced views that Beijing will roll out fresh support measures soon.