Mumbai, Sept. 20: Tata Steel and Germany's Thyssenkrupp agreed on Wednesday to merge their European steel operations to create the continent's second largest steel maker.

The deal, which is preliminary, will help the companies to address overcapacity in Europe's steel market, which faces cheap imports from overseas, subdued construction demand and inefficient legacy plants. The merger will also result in up to 4,000 job cuts, or about 8 per cent of the joint workforce.

The transaction will not involve any cash, Tata Steel said, adding both groups would contribute debt and liabilities to achieve an equal shareholding and remain long-term investors.

"We want to avoid our steel team restructuring itself to death," Thyssenkrupp CEO Heinrich Hiesinger told reporters at Essen in Germany, noting its steel operations would face deeper restructuring needs if they remained part of the group.

"No one is able to solve the structural issues in Europe alone. We all suffer from overcapacity and that means that everyone is making the same restructuring efforts," Hiesinger said.

Tata Steel chairman N. Chandrasekaran today said in Mumbai that the transaction will ensure a sustainable business in Europe and a key feature of the deal is that production sites of Ijmuiden and Port Albot will be intact.

Pecking order

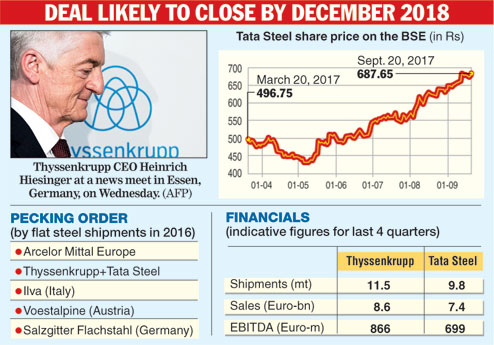

The new joint venture, Thyssenkrupp Tata Steel, will be Europe's biggest steel maker after ArcelorMittal and will be based in Amsterdam.

The proposed joint venture will have annual shipments of about 21 million tonnes of flat steel products. It would have a pro form a annual turnover of about 15 billion euros (Rs 115,000 crore). At present, the two companies employ 48,000 people spread across various locations. The deal is likely to be closed by December 2018.

With an MoU now signed, the process will move to the next phase in the transaction with due diligence and negotiations on the definitive detailed agreements.

The combination is subject to execution of the final agreements and obtaining all corporate authorisations, including approvals from the Tata Steel board and shareholders. The completion of the deal will be contingent upon certain conditions, including obtaining requisite competition approvals.

Other benefits

The proposed deal will have a positive impact on the domestic operations of Tata Steel, which can now utilise its cash flows to grow both organically and inorganically. This comes even as debt of around Rs 18,000 crore will go off the consolidated balance sheet of Tata Steel to the new joint venture firm.

Speaking to reporters here today, Koushik Chatterjee, group executive director of Tata Steel, said that based on an initial assessment, annual cost synergies of 400-600 million euros may be realised through the integration of commercial functions, common procurement & logistics, combined R&D and higher utilisation of downstream steel capacity.

Chatterjee said the proposed joint venture was about growth and value and not about rationalisation and jobs.

He indicated that term debt of 2.5 billion euros would go to the books of the joint venture firm from Tata Steel.

Sources here added that while the latter had a net debt of around Rs 72,000 crore for the quarter ended June 30, around Rs 18,000 crore will move out and the rest will remain on the balance sheet of Tata Steel.

The stock markets gave its thumbs up to the deal with the Tata Steel stock rising 1.64 per cent or Rs 11.10 to finish at Rs 687.65 at the BSE.

Thyssenkrupp shares rose 3.2 per cent, bolstered by hopes the joint venture will also ease the burden on its balance sheet, which will be freed from 4 billion euros ($4.8 billion) in mostly pension liabilities.

The companies have been in merger talks for around two and half years now.

The UK government and unions said they welcomed the merger so long as commitments made by Tata Steel UK to safeguard jobs and extend blast furnace operations at Britain's largest steelworks in Port Talbot, Wales, were maintained.