The Adani group, which has grown on acquisitions, has fairly solid fundamentals but debt-funded future acquisitions can start putting pressure on ratings, S&P Global Ratings said on Thursday.

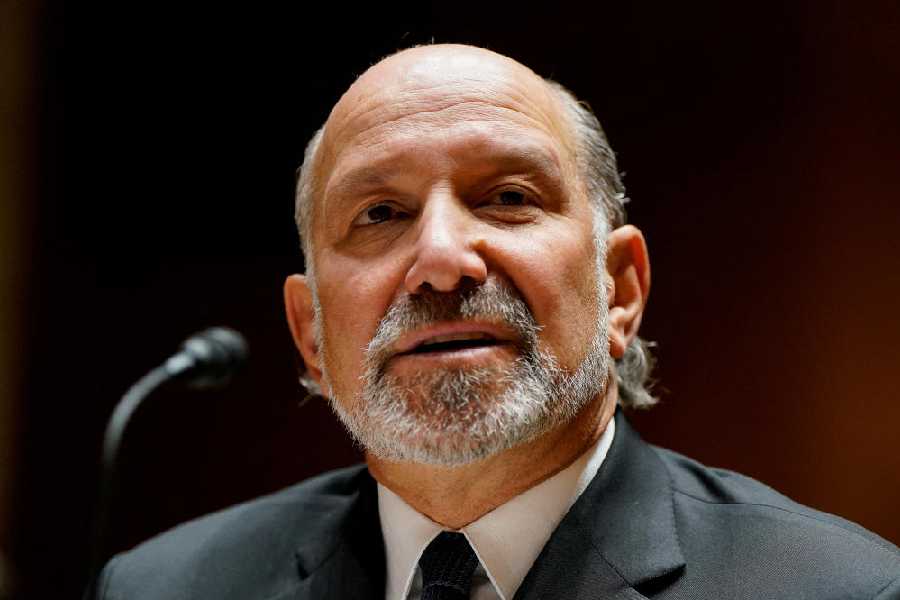

S&P Global Ratings senior director (infrastructure ratings) Abhishek Dangra said the growth ambitions for most of the group entities are fairly high and they have also grown through acquisitions across multiple entities.

“If you look at the rated entities (of Adani group), like Adani Ports, their business fundamental is fairly solid. Port business is generating healthy cash flows. Where, probably, the risk could lie for the group is, some of the acquisitions it is doing. Some of the recent acquisitions that we are seeing are largely debt-funded and that is taking away the headroom,” Dangra said at a webinar.

He said any future acquisition that the group does at the current pace can start putting pressure on its ratings.

“Currently we see that the risks can be managed if the group manages the growth ambitions or the fundings,” he said, adding that the growth that the group is doing in other business segments does not necessarily have a direct impact on the ratings right now.

“The domestic banking system, as well as some international capital bond market investors, do look at Adani entities as a group and many of them, because the group has been raising funds for growth, are looking at a certain kind of group limit or limiting their exposure to one group which can become a challenge when the group continues to keep growing,” Dangra said.