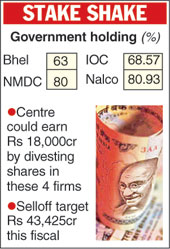

New Delhi, Feb. 10: The government plans to sell stakes of Bhel, NMDC, Indian Oil and Nalco in the current fiscal, which could fetch around Rs 18,000 crore to the exchequer.

Indications are that the stake sale in state-owned explorer ONGC could be shifted to the next fiscal because of continued uncertainty on the subsidy-sharing formula and a fall in global crude prices.

The government had hoped that the stake sale in ONGC would have fetched about Rs 15,000 crore. Along with the Coal India selloff, it would have met the Rs 43,425-crore target set for this fiscal.

However, the government now plans to divest stakes in other state-owned firms in the limited time left in the current fiscal.

The department of disinvestment is slated to finalise a merchant banker to managethe Bhel stake sale tomorrow. Among those contending to manage the 5 per cent stake sale include Citigroup, SBI Capital, ICICI Securities, Axis Capital, Edelweiss and IDBI.

The stake sale in these firms will fetch the government about Rs 18,000 crore (Rs 8,100 crore from Indian Oil; Rs 3,500 crore from Bhel; Rs 1,230 crore from Nalco; and Rs 5,426 crore from NMDC).

The government owns 68.57 per cent in IOC, 63.06 per cent in Bhel, 80.93 per cent in Nalco and 80 per cent in NMDC.

So far in this fiscal, the government has raised nearly Rs 1,700 crore through a 5 per cent share sale in steel maker SAIL and earned Rs 24,000 crore from the CIL stake sale.

Divestment is the key to meet the Modi government's promise of narrowing the fiscal deficit to 4.1 per cent of GDP in the current financial year.

In the first eight months of the fiscal, the deficit has already touched 98.9 per cent of the full year target of Rs 5.31 lakh crore as revenue collections have been sluggish, while expenditure has paced ahead.

The government has gained some headroom from the drop in oil prices, which has allowed it to raise excise levies and save on subsidies.

Finance minister Arun Jaitley in the budget in July 2014 had pegged India's divestment target for the current fiscal at an all-time high of Rs 58,425 crore - Rs 43,425 crore from the sale of stocks in state-run firms and another Rs 15,000 crore from the disposal of residual stakes in erstwhile government-owned firms.