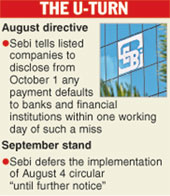

Mumbai, Sept. 30: Market regulator Sebi has deferred the implementation of its directive that required listed firms to inform stock exchanges if they defaulted on loan repayments to banks and financial institutions.

The directive, which was to take effect from tomorrow, has been deferred "until further notice".

"It has been decided to defer the implementation of Sebi circular no. CIR/CFD/CMD/93/2017 dated August 4, until further notice,'' the Securities and Exchange Board of India (Sebi) said in a terse press release issued yesterday.

Sebi, however, did not state the reason for the deferment.

Last month, Sebi had directed listed companies to disclose from October 1 any payment defaults to banks and financial institutions within one working day of such a miss.

The move came against the backdrop of the government and the RBI stepping up efforts to tackle the menace of bad loans amounting to over Rs 8 lakh crore.

"Corporate houses in India are even today primarily reliant on loans from the banking sector. Many banks, at present, are under considerable stress on account of large loans to the corporate sector turning into stressed assets and non-performing assets (NPAs). Some companies have also been taken up for initiation of insolvency and bankruptcy proceedings," Sebi had said in its directive in August.

The market regulator had asked listed entities to inform exchanges in case it defaulted on payment of interest, instalment obligations on debt securities and loans from banks and financial institutions and external commercial borrowings (ECBs).

"The entities shall make disclosures within one working day from the date of default at the first instance of default in a specified format," Sebi had said.

At present, Sebi's listing guidelines require specific disclosures on delay or default in payment of interest or principal on debt securities, including listed non-convertible debentures, listed non-convertible redeemable preference shares and foreign currency convertible bonds.

Similar disclosures are not required with regard to loans from banks and financial institutions.

In July, Sebi had asked listed banks to make disclosures if provisioning and NPAs assessed by the RBI exceeded 15 per cent of published financials.

Sebi had said such disclosures should be made along with the annual financial results filed immediately following communication of such divergence by the RBI to the bank.

The move was aimed at helping banks recognise their stressed assets as non-performing more uniformly.

Hedge funds

Sebi has asked hedge funds to report about cumulative net investments, made by them in commodity derivatives in a prescribed format.

Besides, such funds need to inform about the maximum investment made by them in a single underlying commodity and their monthly exposure.

Category-III alternative investment funds (AIFs) or hedge funds have to submit the monthly/quarterly report in the revised format for the period ended September 30 onwards.

In June, Sebi allowed hedge funds to invest in commodity derivatives, in a move to deepen the market and boost liquidity.