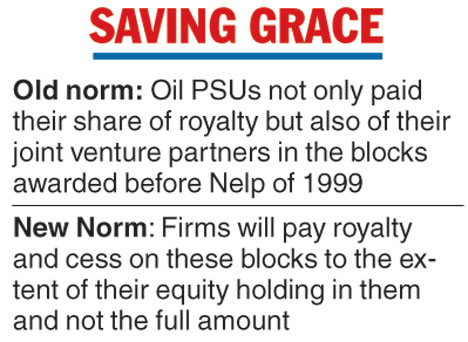

New Delhi: State-owned ONGC Ltd and Oil India will pay royalty and cess on the oil blocks awarded to them before 1999 to the extent of their equity holding in these blocks and not the full amount.

Under the present norms, the oil PSUs not only paid their share of royalty but also of their joint venture partners in these blocks, which were awarded before the New Exploration and Licensing Policy (Nelp) of 1999.

Wednesday's cabinet decision will ensure greater investments in the blocks.

The Cabinet Committee on Economic Affairs (CCEA) also extended the special dispensation of marketing and pricing freedom to natural gas produced from areas in the north-eastern region, petroleum minister Dharmendra Pradhan told reporters here.

The cabinet also extended the time period given to oil and gas companies to develop hydrocarbon blocks in the north- eastern region. Besides, income tax benefits have been extended to all the 28 oil and gas fields awarded before Nelp in 1999.

Background

Pradhan said the government had awarded some discovered oil and gasfields to private players in the 1990s.

However, the liability of the payment of statutory levies such as royalty and cess was put on the PSUs, who were made licensees. ONGC and Oil India were allowed to take interest of 30-40 per cent in the fields, but were liable to pay 100 per cent of the statutory levies.

The minister said fresh investments were getting stalled as the state-owned firms were not keen to incur more liabilities. The joint venture partners such as Vedanta, Essar Oil, GSPC, Focus Energy, Hindustan Oil and UK's Hardy Oil would now have to bear their share of the statutory burden. Most of the blocks are located in Gujarat and Rajasthan.

The levy, however, will be paid with prospective effect. Besides, the private parties can deduct the levy from the sale of hydrocarbons before sharing the profit with the government.

The CCEA also decided to extend the benefits under Section 42 of the Income Tax Act, 1961 prospectively to operational blocks under pre-Nelp discovered fields for the extended period of the contract.

Section 42 allows companies to claim 100 per cent of expenditure as tax deductible.