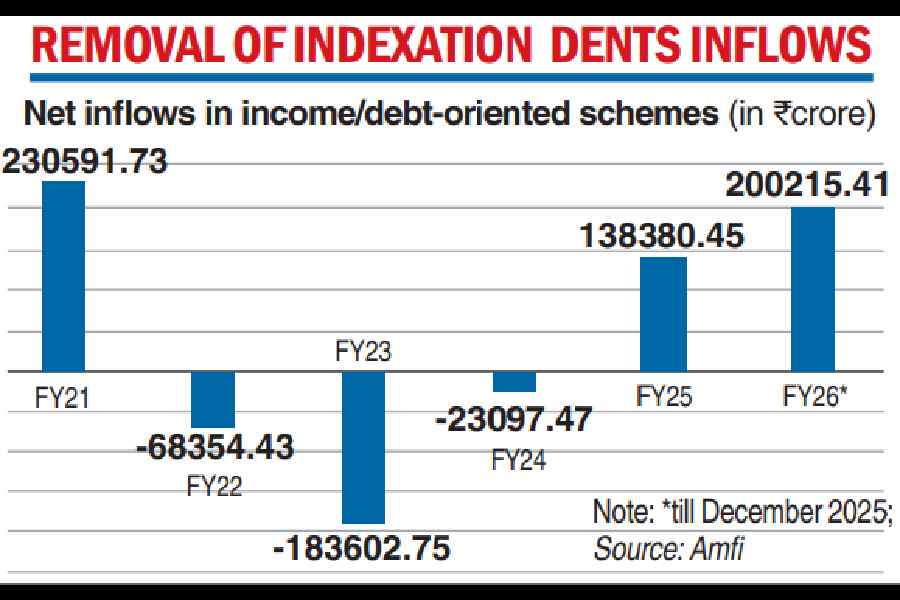

The Association of Mutual Funds in India (Amfi) has sought the restoration of long-term capital gains (LTCG) with indexation benefits for debt mutual funds, which were withdrawn in 2023, saying the move has materially reduced long-term participation in fixed-income products and dented inflows into debt schemes.

Amfi has proposed that gains on debt funds held for over three years be taxed at 12.5 per cent or 20 per cent with indexation, a change it believes will revive investor interest, support senior citizens who rely on stable income products, and strengthen the corporate bond market by providing a steady pool of long-horizon capital.

Following the implementation of Finance Act 2023, most debt mutual fund gains are taxed at slab rates regardless of holding period under section 50AA of Income-tax Act, 1961 [section 76 of the Income tax (No. 2) Bill, 2025].

Amfi has also recommended the introduction of a Debt-Linked Savings Scheme (DLSS) with a five-year lock-in and a dedicated tax deduction outside the crowded Section 80C basket. The proposed scheme would invest largely in high-quality debt and offer a separate deduction in both the old and new tax regimes, complementing the restoration of indexation for debt funds, and help mobilise long-term money for corporate and infrastructure financing.

On the equity side, Amfi has called for parity in taxation across different mutual fund structures. It has urged the government to amend the definition of equity-oriented funds to include fund-of-funds (FoFs) that invest predominantly in equity mutuals, arguing that, despite indirect exposure to domestic equities, such FoFs are taxed as non-equity schemes.

It has also sought a relaxation of outdated rules governing equity-linked savings schemes (ELSS), including the removal of the requirement that investments be made in multiples of ₹500.

It has recommended a separate tax deduction for ELSS investments under the new personal tax regime, warning that the absence of any distinct incentive risks is eroding ELSS’s role as a simple, low-ticket entry point for first-time equity investors.

On retirement savings, Amfi has suggested that all mutual funds be allowed to launch pension-oriented schemes with tax treatment on a par with the National Pension System, including deductions for both employee and employer contributions and an exempt–exempt–exempt tax regime. It has also proposed a voluntary retirement account modelled on the US 401(k), managed by mutual funds, to widen pension coverage, reduce future social security burdens on the exchequer, and channel long-term household savings into capital markets.

Amfi has also sought exemption for intra-scheme switches.