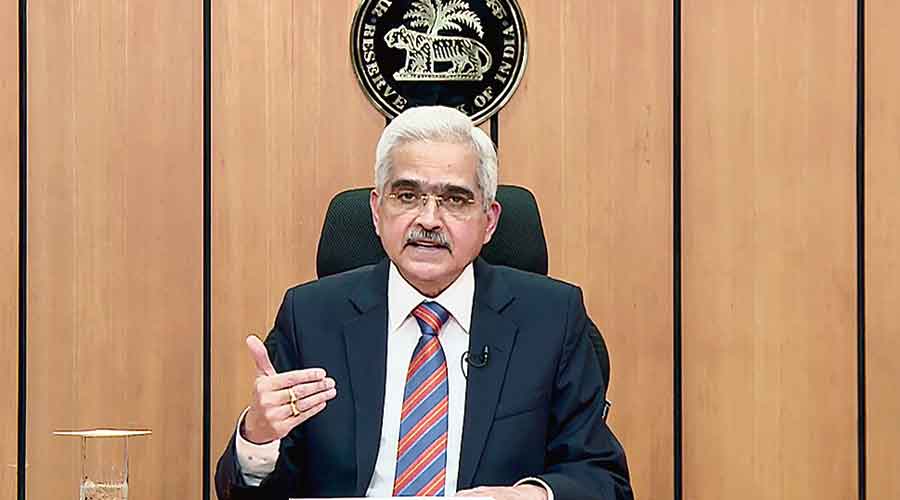

Reserve Bank of India governor Shaktikanta Das has stoutly defended the central bank’s decision to remain cautious and circumspect in its fight against runaway inflation by delaying interest rate hikes until early May while its peers had fired the blunderbuss months in advance.

Das said the RBI – which has been accused of falling behind the curve in its fight against inflation – delayed the rate action because it could hurt businesses by raising borrowing costs and jeopardise the post-pandemic economic recovery.

An interest hike is a traditional weapon in the monetary policy arsenal that central bankers use to quell inflation even though many believe it is a blunt instrument that doesn’t always prove to be effective.

The monetary policy committee (MPC) of the RBI has raised the policy repo rate by 190 basis points since an unscheduled meeting in May that has pinched borrowers in the form of high interest rates for home and other loans.

Critics have said that the sharp increases — 40 basis points in May followed by three consecutive increases of 50 basis points — by the RBI came as it was behind the curve in tackling inflation. They have pointed out that the India’s retail inflation was above the medium-term target of four per cent since October 2019 and that the RBI was late to act.

However, the RBI governor feels otherwise. Speaking at the annual FIBAC conference of bankers here, Das said the debate on whether it dithered in the inflation fight is over.

"Step back for a moment, pause for a moment, and think about…if we had started the process of tightening earlier, what would have been the counterfactual scenario? What you prevent in the process doesn’t get the kind of appreciation that it should get,” Das said.

“Yes, there has been a slippage in our inflation targeting, in our capacity to, in our ability to maintain inflation below 6 per cent, but it (tightening earlier) would have been very costly for the economy. It would have been very costly for the citizens of this country, we would have paid a high cost. And I think that is something that needs to be appreciated.”

Das pointed out that its initial projections showed that retail inflation would be around 4.5 per cent in 2022-23. Its professional forecasters also expected a similar inflation trajectory.

He said it was Russia’s invasion of Ukraine that upset its calculations as it led to a spike in commodity prices globally. “We wanted the economy to safely land the shores and reach the shores and thereafter try and pull down inflation. But then the war between Russia and Ukraine started in February and the global crude and other commodity prices shot up within matter of days,’’ he said.

The RBI governor observed that its restraint in raising interest rates early prevented a downturn in India. This has now resulted in the domestic economy bouncing back in 2021-22 and 2022- 23 after a record contraction in the first quarter of 2020-21 and now displaying resilience amid challenging global conditions.

Das’ vigorous defence comes on the eve of an additional meeting of the MPC which will formulate a response to the government for failing to meet the inflation target.