The Reserve Bank of India (RBI) will pay an interim dividend of Rs 28,000 crore to the government, a move that will help the Centre to bridge the fiscal gap and enable it to plough funds into populist schemes in an election year.

The announcement came after the RBI’s central board meeting on Monday, though the dividend was along expected lines.

“Based on a limited audit review and after applying the extant economic capital framework (ECF), the board decided to transfer an interim surplus of Rs 28000 crore to the central government for the half-year ended December 31, 2018,” the RBI said.

The ECF, which refers to the capital required by the central bank to handle various risks, determines the surplus which is transferred to the government. The central bank transfers its surplus amount to the government, under Section 47 of the RBI Act, 1934.

Section 47 of the Act says: “After making provision for bad and doubtful debts, depreciation in assets, contribution to staff and superannuation fund and for all matters for which provision is to be made by or under the Act or which are usually provided by bankers, the balance of the profits shall be paid to the central government.”

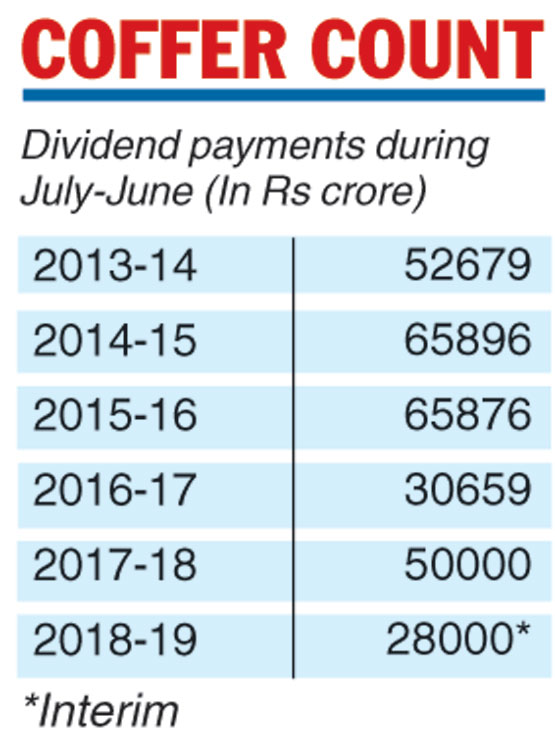

This is the second successive year the RBI will transfer an interim surplus. The central bank had transferred Rs 50,000 crore in 2017-18 (the RBI follows July-June financial year), of which Rs 10,000 crore was interim dividend paid in March 2018. The RBI in the current fiscal has given Rs 68,000 crore as dividend, including the interim dividend announced on Monday. The sum includes the Rs 40,000 crore which the RBI had paid as final dividend for 2017-18.

The apex bank paid Rs 52,679 crore dividend in 2013-14, which went up to Rs 65,896 crore in the following year. However, it fell to Rs 30,659 crore in 2016-17 because of demonetisation.

The Telegraph

The government was keen on the interim dividend as tax collections had been below expectations. In the interim budget, the Centre had said it expected to get Rs 82,911.65 crore as dividend from the RBI, banks and financial institutions in the next fiscal.

Collections for the current fiscal had been revised to Rs 74,140.37 crore from the earlier estimate of Rs 54,817.25 crore, which is likely to be reached following the interim dividend announced on Monday.

The payment comes at a time a panel under former RBI governor Bimal Jalan is looking into the appropriate size of reserves of the RBI and the dividend to be paid to the government.

The Centre was at loggerheads with the RBI under previous governor Urjit Patel over the Rs 9.6-lakh-crore surplus with the apex bank.

The finance ministry was of the view that the buffer of 28 per cent of the gross assets maintained by the RBI was well above the global norm of around 14 per cent.