The RBI is planning to adopt the “expected loss’’ approach for loan provisions by lenders.

This practice is currently followed by some large non-banking finance companies (NBFCs). Banks follow the “incurred loss” approach, where money is set aside after an asset becomes stressed.

In the new framework they will have to constantly recognise credit losses given the current conditions of a particular asset and forecast information. This will have to be provided at every reporting date.

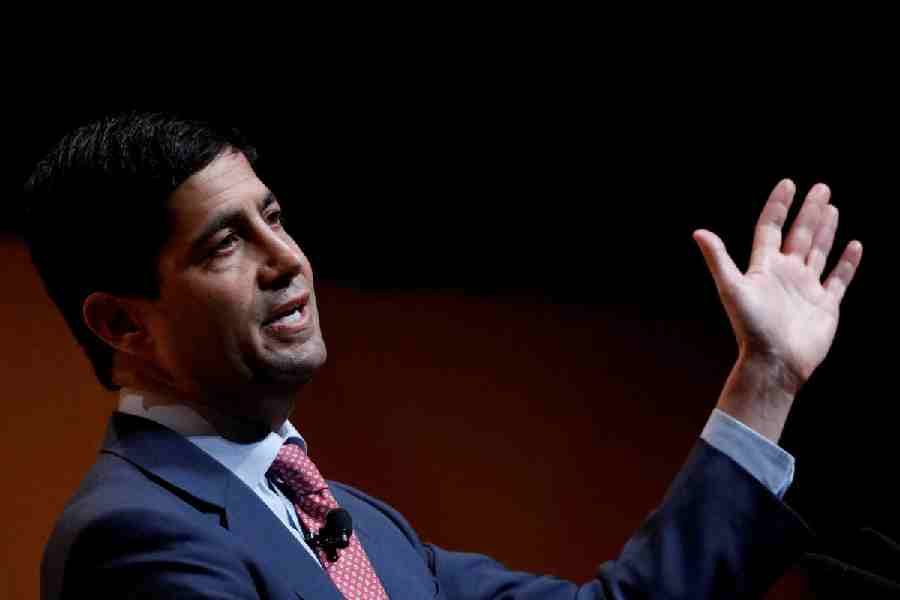

RBI governor ShaktikantaDas on Friday said the central bank has proposed to adopt the expected loss approach for loss provisions. As a first step, a discussion paper on the various aspects of the transition will be issued shortly.

Das called the proposed transition a “more prudent and forward looking approach”.

The RBI will also release another discussion paper on a revised framework for securitisation of stressed assets after overhauling the same for standard assets in September 2021.