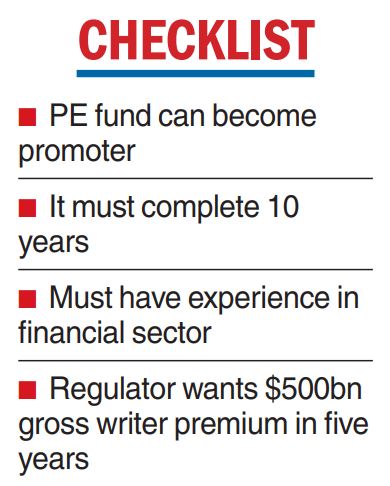

The insurance industry regulator has proposed changes that could allow private equity funds to have a wider role including as promoters in insurance companies.

The draft IRDAI (Registration of Indian Insurance Companies) Regulations, 2022 has provided the criteria of investment by private equity players.

The aim is to bring in more investor interest and capital needed for the industry’s projected growth of a $500 billion gross writer premium 2027.

According to the IRDAI draft proposal, a private equity (PE) fund may invest in any insurer in the capacity of “promoter” on the condition that it should complete 10 years of operation.

The funds raised by the PE including its group entity(ies) is $500 million or more (or its equivalent in rupees).

The investible funds available with the PE is not less than $100 million.

The fund must have investments in the financial sector in India or other jurisdiction.

A new introduction in the proposed changes is the “fit and proper” criteria to be classified as a promoter or an investor in an Indian insurance company.

The regulator will look at the financial strength, ability to infuse capital to meet solvency and regulatory requirements, compliance with the existing laws including Fema and taxation laws along with the business record and experience of the applicant.

The regulator will also take into consideration areas of due diligence such as insider trading, fraudulent or unfair trade practices or market manipulation by the fund or any of its promoters/group entities, governance and capital structure and sources of funds.

The regulator has also introduced lock-in periods whereby the equity shares of the promoter or the investor will be locked in for certain tenure from the time of investment.

For instance, if the investment is made by the promoter at the time of grant of certificate of registration of the insurance company, the lock in period is proposed at five years.

If the investment is made after 10 years of grant of certificate of registration, the lock in for the promoter is two years and for the investor three years.

The regulator has also streamlined the process of registration of insurance companies in a bid to improve the ease of business, a criteria which is keenly looked at by overseas investors.

Bima Sugam

IRDAI has also planned a digital platform called “Bima Sugam” for selling, servicing and settling claims.

In essence, it will act as an Amazon-like platform where all life and general insurance policies can be listed.