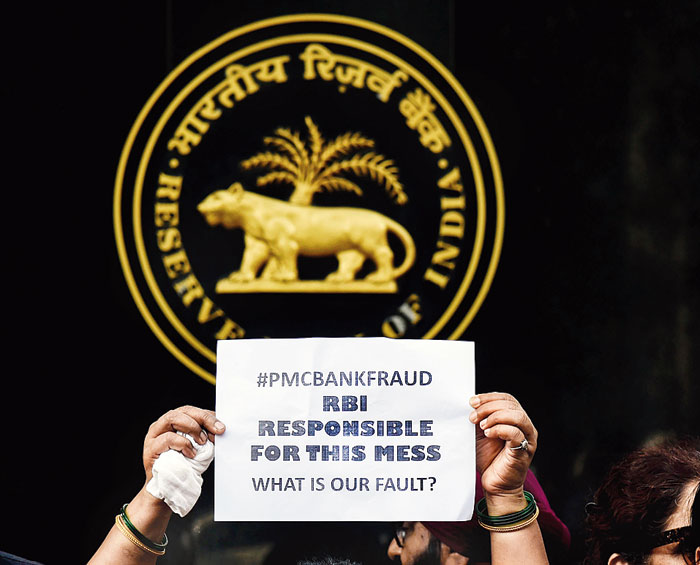

In what should come as a relief to depositors of PMC Bank, the Reserve Bank of India (RBI) on Friday raised the withdrawal limit to Rs 1 lakh. However, the RBI extended the regulatory restriction on the cooperative bank by another six months till December 22.

The RBI had earlier placed a withdrawal limit of Rs 50,000 per depositor. The banking regulator had placed curbs on Punjab and Maharashtra Cooperative Bank Ltd, Mumbai, on September 23 last year after finding out certain financial irregularities and hiding and misreporting of loans given to real estate developer HDIL.

A statement from the RBI said that with the latest relaxation on withdrawal, more than 84 per cent of the depositors will be able to withdraw their entire account balance.

The withdrawal limit was last enhanced to Rs 50,000 per depositor on November 5, 2019, and the restrictions were extended till June 22, 2020.

“Further, on a review of the bank’s liquidity position, its ability to pay the depositors and with a view to mitigating the difficulties of the depositors during the prevailing Covid-19 situation, it has been decided to enhance the limit for withdrawal to Rs 1,00,000 per depositor, inclusive of Rs 50,000 allowed earlier,” the RBI said in a statement.

The RBI added that it has been engaging with the stakeholders to explore the possibility of a resolution of the bank.

However, the process has been affected because of the lockdown and the continuing uncertainty around the pandemic. The extent of the negative net worth of the bank and the legal processes involved in the recovery of bad debts also pose challenges.

Earlier, the central bank had superseded the board of PMC Bank and appointed J. B. Bhoria, an ex-RBI official, as its administrator.

The RBI had placed restrictions on the bank that included barring the bank from giving fresh loans and acceptance of fresh deposits.