The shares of One97 Communications Ltd, the Paytm parent, were clobbered on Thursday as SoftBank sold 4.5 per cent in the fintech firm.

Data from the National Stock Exchange (NSE) showed the Japanese conglomerate, which holds nearly 17.5 per cent in One97 Communications, selling 2.94 crore shares at Rs 555.67 apiece worth nearly Rs 1,631 crore.

The shares were sold by SVG India Holdings. Some of the investors who purchased these shares include BofA Securities Europe, Morgan Stanley Asia Singapore PTE and Societe Generale.

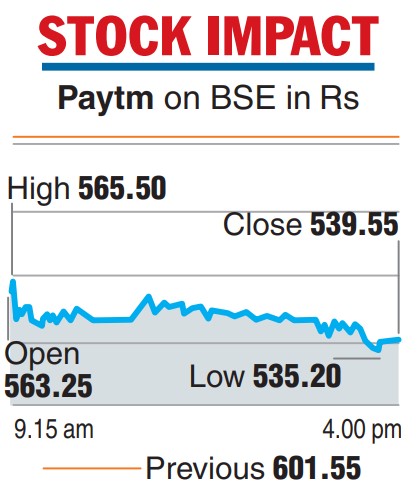

The sale by SoftBank resulted in the shares of Paytm taking a knock of over 10 per cent. It ended at Rs 539.55 on the BSE, marking a fall of 10.31 per cent or Rs 62.

Close to 43.24 lakh shares were transacted on the bourse against the two-week average of 1.24 lakh shares.

Paytm finished 10.78 per cent, or Rs 64.85, lower at Rs 536.60 on the NSE. More than 5.72 crore shares worth nearly Rs 3,158 crore were transacted on the exchange.

One97 Communications has a market cap of over Rs 35,000 crore at the current market price compared with the issue price of Rs 2,150 per share, with the share trading at a discount of nearly 75 per cent.

The sale is the latest in a string of divestments that SoftBank has made in the past few months, after its flagship Vision Fund unit booked nearly $50 billion in losses in just six months.

Vision Fund sold a range of assets in the April-June quarter — including ride-hailer Uber Technologies and property platforms Opendoor Technologies and KE Holdings, which operates China’s Beike — for a realised gain of $5.6 billion.

Paytm went public last year in India’s biggest-ever IPO, but the shares skidded as low as 70 per cent below listing price in the months after the listing.

Meanwhile, there was some respite for the investors of FSN E-Commerce which owns the brand Nykaa as the share ended almost sideways on the NSE after coming under pressure since November 10 when holding restrictions were removed on its pre-IPO investors.

Canada Pension Plan Investment Board (CPPIB) on Thursday bought over 1.70 crore shares of FSN E-Commerce Ventures for Rs 299 crore through an open market transaction. CPPIB purchased a total of 1.7 crore shares of the company, according to bulk deal data on the BSE.