New Delhi: State-owned explorer ONGC Ltd plans to invest $5 billion in developing oil and gas discoveries in KG (Krishna-Godavari) basin block KG-DWN/98/2, which lies next to the Reliance Industries' block. Production from the block is expected to start in 2020.

The development of the block is part of the company's strategy to double its oil and gas outputs in the next four years.

"We plan to invest Rs 92,000 crore in 35 major projects, which include bringing 14 new finds to production and improving recovery from six ageing fields. We have almost 70 per cent of the oil production coming from mature fields. My primary challenge is to step up production," ONGC chairman and managing director Shashi Shanker said.

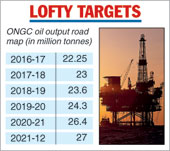

The plan on the table is to raise crude oil production to 27 million tonnes (mt) by 2021-22 from 22.25mt in 2016-17.

The natural gas output is envisaged to rise to 42 billion cubic meters (115 million standard cubic meters per day) in 2021-22 from 22 billion cubic meters (60 million standard cubic meters per day), he said.

The oil deposits in the KG basin cluster 2A hold estimated in-place reserves of 94.26mt of crude oil and 21.75 billion cubic metres (bcm) of associated gas, while cluster 2B has estimated in-place reserves of free gas of 51.98bcm. Total oil and gas production estimated from the project is 23.52mt and 50.706bcm, respectively.

ONGC's road map to raise the output comes two years after Prime Minister Narendra Modi set the target to reduce the country's dependence on oil imports by 10 per cent from 77 per cent in 2013-14.

India spent almost $1 trillion on crude imports between financial years 2005-06 and 2015-16. The company's oil production will rise to 23mt in the current fiscal and to 23.6mt in 2018-19.

"The challenges facing ONGC, as I see, include finding out ways to increase domestic production, delivering projects under implementation on time and attrition," he said.

Also, natural gas pricing is a challenge as the current rate of $2.89 per million British thermal unit is way below the $4.5 needed to cover the cost and provide a reasonable return, he added.