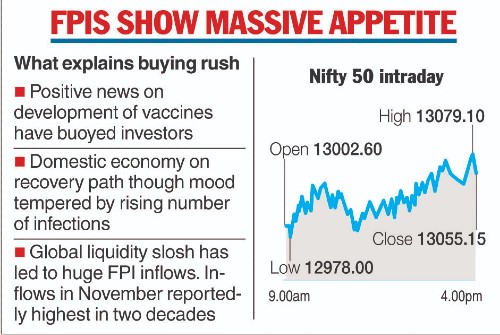

The Nifty on Tuesday closed above the 13000 mark for the first time and the Sensex scaled new peaks riding on banking, auto and FMCG stocks as reports of progress in Covid-19 vaccine trials boosted the hopes of a swift economic recovery with robust inflows of foreign portfolio investors (FPIs) providing additional ballast.

The Dow Jones Industrial Average also topped 30000 for the first time ever on Tuesday, extending a stock-market rally attributed to continued progress toward a Covid-19 vaccine as well as the removal of a roadblock to a smooth transition to a Biden administration.

However, trading volumes were expected to remain subdued ahead of the Thanksgiving holiday on Thursday when markets will be closed, with only half a day of trading scheduled for Friday.

Investors in India took their cues from positive results of the coronavirus vaccine in safety trials. Five vaccine candidates are in advanced stages of development in India, of which four are in Phase II/III trials and one in in Phase-I/II level. Prime Minister Narendra Modi on Tuesday held a meeting with the chief ministers where they discussed the creation of cold storage facilities for the vaccine.

Various high frequency indicators have recently shown the domestic economy is picking up steam and market circles said the expectations of a speedy recovery are behind the rush to buy stocks even though some regions are reporting an increasing number of infections leading to apprehensions of restrictions being reimposed by some states.

A crucial factor is the huge global liquidity that has led to strong FPI inflows. So far in November, these investors have brought stocks worth a whopping Rs 53,000 crore. Provisional data showed they made net purchases of over

Rs 4,563 crore on Tuesday. During this calendar year, they have invested more than Rs 1 lakh crore in equities.

“I have never seen such frenzied buying by foreign investors in the secondary markets. Not even in 2007 did we see such euphoric buying in such a short period of time,” investment adviser Sandip Sabharwal tweeted.

Hemang Jani of Motilal Oswal Financial Services said the purchases by the FPIs in November are the highest in the last two decades.

Corporate performance has also been much better than analyst expectations, while the fears of a spike in bad loans have been replaced by optimism on better collection efficiency and improved asset quality.

Covid-19 vaccine trials boosted the hopes of a swift economic recovery with robust inflows of foreign portfolio investors (FPIs) The Telegraph Picture

“The overall sentiments are strong and the market outlook is positive going forward. If the foreign fund inflows continue we can see higher levels on Nifty in coming days or weeks. Nifty can possibly touch 13200-13400 levels also,” according to Motilal Oswal’s Jani who heads the equity strategy, broking and distribution business of the firm.

“But it also depends on the sustainability of the economic growth over the next few months after the festive season. Hence at the current market levels it is advisable to partially book profits and sit on 15-20 per cent cash in the portfolio. Any corrections in the market can be used to deploy funds at lower levels,” Jani said.

The 30-share Sensex opened strong at 44341.19 and scaled a lifetime intra-day high of 44601.63. It later settled 445.87 points or 1.01 per cent higher at a record 44523.02. Similarly, the broader NSE Nifty climbed 128.70 points or 1 per cent to close above the 13000 mark at 13055.15.

RIL-Google deal

RIL on Tuesday notified the bourses that Google has paid Rs 33,737 crore for a 7.73 per cent stake in its digital subsidiary, Jio Platforms Ltd, joining the list of global investors such as Facebook.

With this, Jio Platforms has raised a total of Rs 1.52 lakh crore by selling nearly a 33 per cent stake to 13 financial and strategic investors in just 11 weeks. This has helped RIL erase its net debt much ahead of the March 2021 target.