Most investors are not able to build a successful strategy when it comes to mutual fund investing. This is because investors fall prey to randomly investing in the market without a proper plan.

A simple checklist is likely to help investors make an informed choice rather than a random one. Let us now go through a six-point checklist.

Help from financial adviser

A great way to begin and avoid being overwhelmed by the financial markets is to avail yourself the services of a financial adviser. An adviser will guide you to make a proper financial plan tailored for your financial situation by taking into consideration various factors such as your risk-taking abilities, income, assets, and, more importantly, your financial goals. Only after a careful consideration will an adviser recommend strategies and the amount of investment, including funds and other instruments that you could invest in to meet your goals. To keep your personal finances on track, it is also necessary to review the financial plan at regular intervals.

SIP through market cycles

A systematic investment plan (SIP) is a strategy that encourages regular investments in financial assets. To ensure that you maximise on the power of your SIPs, you have to continuously invest across the up and down cycle of the market. Investors tend to stop their SIPs during market corrections, but one must realise that these are the best times to invest in the markets as one has the opportunity to park their funds at better valuations.

Investing through the market cycles helps you benefit from higher allocations during market corrections and also lets your portfolio participate in the market rallies.

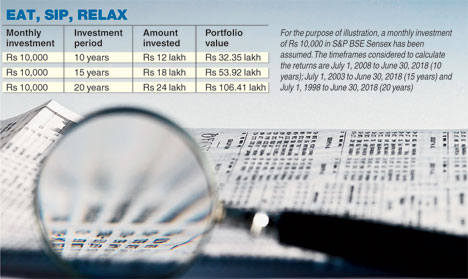

Compounding is another ancillary benefit that will aid you in the long run. Keeping SIPs going throughout market cycles sets the stage for long-term growth for your portfolio. The above chart illustrates how regular investing through SIPs will help your portfolio.

Don't ignore debt funds

Diversification among asset classes is the key when one is building long-term wealth. When one is inclined to investing in equities given the possibility of high returns over long term, it is important to remember to add debt mutual funds to the portfolio to strike a balance.

Debt mutual funds invest in a variety of fixed-income assets such as government securities, short-term paper, T-bills and corporate bonds. The presence of debt helps to reduce the risk element of a portfolio too, given the periodic repayments of interest, making it a steadier asset class.

Debt funds mainly aim to generate returns from accrual income and potential capital appreciation through the changes in interest rates and credit ratings. While the duration funds are primarily aimed at benefiting from interest rate movements, accrual funds target fixed income securities with higher yield-to-maturity to generate predictable returns for the investors.

Include large cap

Your core investing plan should include large-cap and balanced advantage funds. That's because large-cap stocks have a lesser propensity to fluctuate owing to their robust balance sheet and steady growth. Having a large-cap bias for your investment plan also helps you to choose the sector leaders across multiple segments instead of having too many stocks in a single sector. Large-cap stocks have steered through their journey of growth with their strong fundamentals and capable of delivering consistent long-term returns.As a result, a large cap fund can act as an anchor to one's equity investment and should remain a part of the core allocation.

Follow asset allocation

If one wants to get a better investor outcome, consider asset allocation. You need to have a suitable mix of investments in your portfolio which will include equity, debt, gold and other asset classes, as deemed fit by a financial adviser. Such an arrangement ensures that even if one or the other asset class fails to perform as expected, the overall impact on the portfolio is tempered.

However, at this point, it is important to note that making an asset allocation once and forgetting it is not the way. Based on the decision made with the financial adviser, it is important to see that the portfolio is re-balanced as and when required. For example: If the initial allocation to equity was 50 per cent, and thereafter it rises to 70 per cent, to maintain your asset allocation you will cut back on equity by 20 per cent and allocate more to other asset classes. This ensures that your portfolio allocation is according to the desired level, aiding the objective of long-term wealth building.

Go for dynamic plans

If your are planning a lumpsum investment in the current market condition, invest in dynamic asset allocation funds. Dynamically managed funds shift between equity and debt depending on the market valuation, that is when equity valuations rise, these funds automatically switch to debt investments, thus booking profits at higher levels. When equity markets correct, such funds build up position in equities, ensuring you are buying equities at lower prices, essentially following the philosophy of buying low and selling high. As such, it helps you avoid emotional bias as the investing decisions are based on the valuation metrics.

Such a strategy ensures that the portfolio is primed to tap various market opportunities most of the times.

The writer is MD & CEO of ICICI Prudential AMC