Assets of mutual funds rose to a little over Rs 24 lakh crore by November-end, an increase of 8 per cent over the preceding month, on strong inflow in liquid schemes.

Industry body Amfi is hopeful many more investors will choose mutual funds as their preferred option to grow their wealth next year.

“As India becomes the fastest growing economy and with inflation rates slowing down, equities are expected to perform better in the near future. We are hopeful that next year, many more investors will choose mutual funds as their preferred option to grow their wealth,” Amfi chief executive N.S. Venkatesh said.

According to Amfi, the asset under management (AUM) of the industry, comprising 42 players, climbed to Rs 24.03 in November from Rs 22.23 lakh crore at the end of October .

The total asset base of all the fund houses put together was Rs 22.79 lakh crore in November last year.

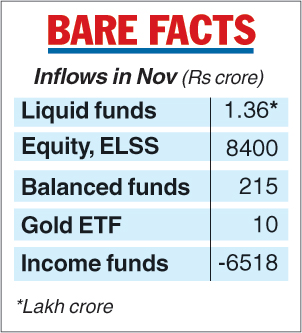

The latest inflow was mainly driven by contributions from liquid funds, equity and equity-linked saving schemes.

Liquid funds attracted Rs 1.36 lakh crore, besides, Rs 8,400 crore was invested in equity as well as equity-linked saving schemes and Rs 215 crore inflow was seen in balanced funds.

Gold ETFs saw a net inflow of Rs 10 crore after witnessing a pullout in the past several months.