Mumbai, June 17: India's insurance sector, which has 24 life and 29 general insurers, is in a consolidation mode as players both big and small eye scale and a better distribution network.

The proposed merger of HDFC Standard Life Insurance Company (HDFC Life), Max Life Insurance Company (Max Life) and Max Financial Services is the first such move in that direction.

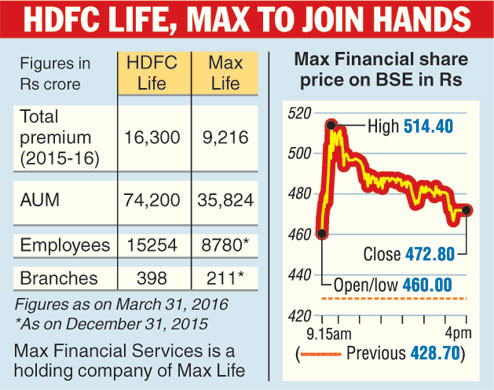

The merger will create the largest private sector life insurer in the country with assets under management (AUM) of over Rs 1 lakh crore and premium income of nearly Rs 26,000 crore.

Life insurance came to India in 1818 and the first key change happened in 1956 when the government nationalised the sector and thereafter in the late 90s when it was thrown open to private players. General insurance was nationalised in 1972.

The number of players in the private sector have subsequently increased, but the much awaited consolidation failed to happen.

The plan

The merger plan of HDFC Life and Max Life comes just days after HDFC ERGO General Insurance Company said it would acquire L&T General Insurance Company (LTGI) for Rs 551 crore in an all-cash deal.

The boards of the three companies - HDFC Life, Max Life and Max Financial Services - at their respective meetings held today approved entering into an exclusivity agreement to evaluate the merger plan.

According to the plan, Max Life will be first merged with Max Financial Services, which will subsequently be amalgamated with HDFC Life, senior officials said.

Following the merger, HDFC Life will be listed on the bourses.

Speaking to reporters here today, Deepak Parekh, chairman of HDFC, said the entire merger process could take up to 12 months, while due diligence and valuation are likely to be done in the next 60 days.

"The IPO plans of HDFC Life has been temporarily put on hold until the due diligence of this deal is done to ascertain whether it will go through or not," Parekh said.

The deal will need approvals from the IRDA, the high courts, shareholders, the Competition Commission of India and the Securities and Exchange Board of India.

Bigger scale

According to Parekh, a consolidation in the private sector will lead to the creation of large companies that can drive economies of scale, thereby servicing customer interests better.

"Currently, an inherent consolidation is visible in the market share of private players. The top four private insurers today constitute 65 per cent of the private insurance market, while the remaining 19 have a combined market share of 35 per cent,'' he said, hinting at one key factor that could trigger consolidation.

Joydeep K. Roy, partner & leader - insurance of PwC India, feels the stage is set for a consolidation.

"While the Indian insurance market has been through several cycles in a relatively short time, the expenses are still to come down to international levels and the scale is not increasing exponentially any more.

"Logically, one will see consolidation, which can come out of a desire to have a larger scale and the ability to address a different clientele, and better synergy in expenses leading to higher value for customers and shareholders,'' he said.

An analyst, however, feels that in the future, more action could be seen among smaller players.

"Despite growing their business, some of the smaller insurers are yet to make their mark in an industry where the Life Insurance Corporation continues to have a solid market share. One can expect some of these to be merged with a much larger player," he said.

Parekh added that the proposed merger also had strong product synergies. HDFC Life is strong in unit-linked products, while Max Life has a higher share of non-ULIP products.

"HDFC Life and Max Life both have strong new business margins, strong bancassurance platforms... the product mix of the combined entity will be well-diversified,'' he said.