Mounting debt has started to chip away at the B.M. Khaitan family’s control over bulk tea major McLeod Russel India Ltd.

Fresh disclosures made to bourses show that nearly the entire shareholding of the promoter — the B M Khaitan family — is now pledged with various financial institutions and at least one of them has dumped shares in the open market recently.

Following the sale of pledged shares by Aditya Birla Finance, promoters’ holding in MRIL has come down sharply from 42.71 per cent, as on March 31, to 38.74 per cent on May 7.

And after a spate of fresh pledges created by the two main promoter group companies — Borelli Tea Holdings Ltd and Williamson Magor & Co Ltd — 98.5 per cent of their holding is now pledged with financial institutions.

During the last five days of April alone, promoters’ pledge galloped from 38.59 per cent to 98.5 per cent, indicating desperation on the part of the owners to raise cash rapidly by mortgaging their holdings.

The Telegraph

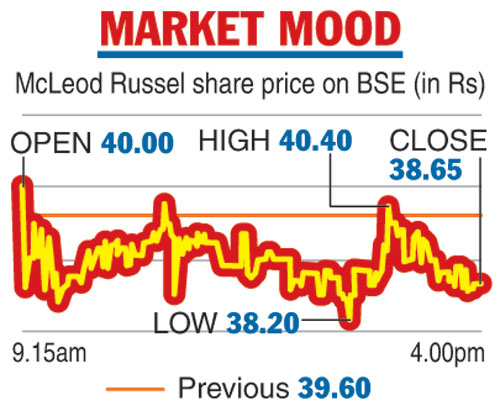

Markets have been punishing companies with high leverage with stocks crashing in the trade. McLeod, the largest bulk tea producer in India having 78 million kg of annual production with overseas gardens, has not been spared either.

Prices have halved since its closing on April 26, the last day before Aditya Birla started dumping pledged shares in the open market. On Thursday, the stock closed at Rs 38.65, down from Rs 76.50 on April 26. The rise in the debt level and multiple downgrades by rating agencies appear to be rattling investors’ confidence.

The company has been on a selling spree since last year, offloading several tea gardens in India and Africa. However, debt continues to remain high and is an area of concern.

Promoters are also exploring other options to raise cash. Eveready is trying to sell the battery business, the mainstay of the company, but efforts are yet to bring results. Squeezed margins from the core tea plantation businesses, aided by high debt exposure in sinking group firm McNally Bharat, have put the balance sheet of McLeod under tremendous strain.