India’s largest steel maker, JSW Steel, may invest in excess of ₹2 lakh crore (trillion) over the course of the next five years to add close to 25 million tonnes in fresh capacity, betting on sustained demand growth and the scale of opportunity offered by the domestic market.

The investment, which will be funded through internal cash flow generation and a judicious amount of debt, will also be deployed towards setting downstream units capable of producing value-added items, mine development, digital infrastructure and AI adoption.

On Friday, the Sajjan Jindal-led company board approved a 5 mt capacity at a new site in Odisha’s Paradip, taking the ongoing capital expenditure over ₹1 lakh crore. Consequently, the company’s capacity will rise to 47.4 mt in India by the end of 2030, according to the board approval.

However, there are multiple other growth opportunities that JSW Steel is exploring, and the company management is confident of receiving board approvals for a few more projects in the next 1-2 years.

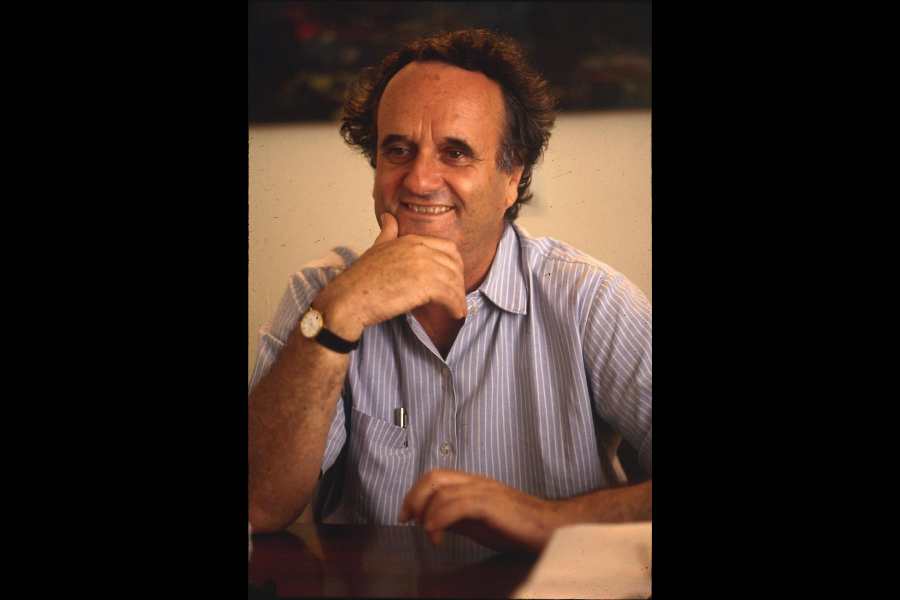

“We will be exceeding ₹2 lakh crore,” Jayant Acharya, joint managing director and CEO of JSW Steel, said in an interview with The Telegraph.

Apart from the ongoing projects, JSW is likely to take up another 5 mt expansion in Karnataka’s Vijayanagar and a 2 mt new capacity with a lower carbon footprint (green steel) in Maharashtra’s Salav, taking the capacity to over 56 mt by FY31.

Moreover, the company also has options to expand the Paradip plant by another 5 mt, double Salav capacity to 4 mt on its own, notwithstanding expanding capacity in Bhushan Power Steel Ltd to 10 mt from 4.5 mt in equal partnership with JFE Steel of Japan.

“If we can go to 55 mt tonnes or more by FY31, including expansion plus downstream, mining digital, (it will be) easily ₹2 lakh crore plus,” Acharya explained.

Despite multi-year low steel prices seen in the last quarter, the price rebounded from the second half of December through January – JSW Steel’s EBIDTA stood at ₹22,335 crore in 9 months, almost touching FY25 generation. The annualised EBIDTA generation of ₹30,000 crore will further get a boost by FY28 when another 7 mt capacity will come on stream.

Moreover, JSW’s balance sheet will be deleveraged by ₹37,000 crore by June, Acharya informed, with JFE picking up a 50 per cent stake in BPSL. The measure will help the company to expand within the guardrails of financial discipline. Acharya said additional volume will be absorbed in the domestic market with 11 mt and 13 mt of additional consumption expected in FY26 and FY27, respectively.

The consumption will mostly be led by public expenditure, which Acharya would like to see in the Union Budget this Sunday, even as private capex is also showing signs of pick up, led by a series of structural reforms and tax cuts, both on the direct and indirect side.

If India’s steel consumption momentum continues, it would take care of challenges in the export markets, especially Europe, where the carbon border adjustment mechanism has come into effect. The company hopes to channelise some of the volumes to the domestic market and non-Europe geography.