Jewellery exporters are betting on an uptick in demand towards the end of 2018-19 and hoping for an overall growth in exports for the fiscal that has till October seen a decline in dollar terms on account of currency fluctuation.

The industry is also in discussion with the government to ease the credit flow to the sector that has taken a hit with public sector banks coming under the ambit of a Prompt Corrective Action framework and the high-risk perception of the industry getting aggravated by the Nirav Modi-scam.

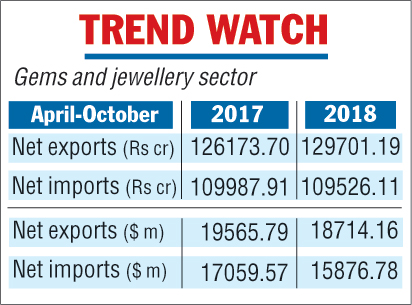

Data from industry body Gems and Jewellery Export Promotion Council show net exports in rupee terms have seen a 2.80 per cent increase between April and October over the corresponding period of the previous year while in dollar terms, there was a decline of 4.35 per cent.

Import of gems and jewellery, which is dominated by rough diamonds, has also seen a decline of 0.42 per cent in rupees and 6.93 per cent in dollars during the April October period over the previous year.

“There are challenges in terms of financing and the industry is in discussion with the government,” said Pramod Kumar Agarwal, chairman of GJEPC, on the sidelines of a jewellery buyer-seller meet in the city on Tuesday.

Telegraph infographic

One of the areas under discussion is the high level of collaterals that are being sought by the banks who themselves are under stress. The industry is in favour of a marginal rise in the collateral requirement on a case-to-case basis.

Another area for government intervention is the sanction of export credit limits in dollar terms. At present, banks calculate export credit limits in rupees, and the limit is apportioned between rupee and foreign currency components, depending on the borrower’s requirements. So, if the rupee depreciates, the exporter gets less foreign currency credit to import raw materials.

Sabyasachi Ray, executive director of the GJEPC, said the limits are reviewed annually as part of the terms and conditions of the bank and the industry is anticipating that their issues would be taken under consideration before March.

Even as the issues are being sorted out, exporters are optimistic of a positive demand from US during Christmas, which in turn would push exports.