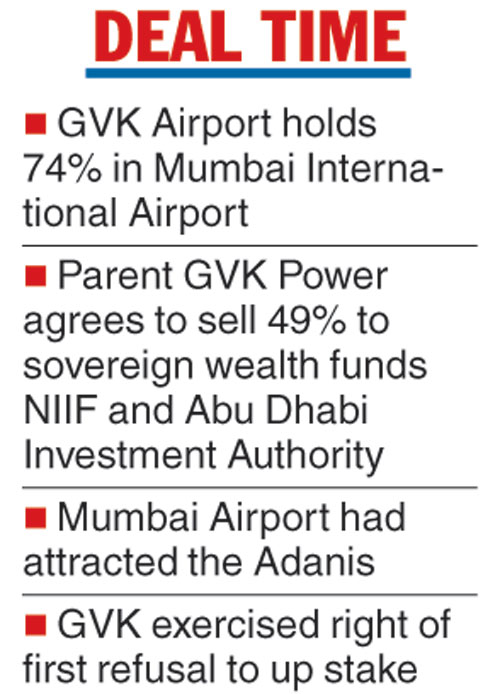

Sovereign wealth funds Abu Dhabi Investment Authority and India’s National Investment and Infrastructure Fund will jointly pick up a 49 per cent stake in Mumbai airport operator GVK Airport Holdings.

Mumbai International Airport Limited (MIAL) had recently attracted the attention of the Adanis, who are aggressively foraying into the airport business.

GVK Power and Infrastructure said it had agreed to offer a 49 per cent stake in GVK Airport Holdings to the sovereign funds.

In a filing with the BSE, GVK Power said the transaction was subject to the conclusion of confirmatory due diligence by ADIA and NIIF, agreement on definitive documents and satisfaction of customary closing conditions, including regulatory and third party approvals and lender consents.

“GVK Airports Developer Ltd (GVKADL) and GVK Airport Holdings Ltd (GVKAHL), subsidiaries of our company, have signed a term sheet and exclusivity agreement with the Abu Dhabi Investment Authority and the National Investment and Infrastructure Fund for an investment in new shares in GVKAHL equating to a 49 percent stake,” the filing said. GVK did not disclose the deal value.

GVKAHL holds a 74 per cent equity stake in Mumbai International Airport Limited (MIAL), which has been awarded a greenfield airport project at Navi Mumbai. The Airports Authority of India holds a 26 per cent stake.

The Telegraph

“GVK had initiated a process to identify and select preferred investors to raise capital to reduce debt obligations of up to Rs 5,750 crore.

ADIA and NIIF were selected as the preferred partners by GVK.

All proceeds from the proposed transaction will be used by GVK towards retiring debt obligations,” it said.

In the annual general meeting held last year, the shareholders gave approval to the board to dilute equity stake, in GVKAHL, a step down subsidiary of the company, through an initial public offer or a private placement or a stake sale so as to utilise the proceeds for the repayment of the balance outstanding obligations of GVKADL.

Adani interest

The GVK group had to fend off the reported interests of Adani Group to pick up a 23.5 per cent stake in GVK Airport from the South African duo Bidvest and Airports Company South Africa.

GVK Power & Infrastructure Ltd on March 22 had informed the exchanges that it would acquire the 10 per cent stake of Airports Company South Africa (ACSA) in MIAL.

It said GVK Airport Holdings Ltd had exercised its right of first refusal to acquire ACSA Global’s stake for Rs 924 crore.

In February, GVK exercised its right of first refusal to acquire Bidvest’s stake in MIAL for Rs 1,247.40 crore.