New Delhi, Jan. 23: The government is inching towards its stake sale target set for the current fiscal by divesting a 10 per cent stake in state-owned manganese miner MOIL tomorrow.

The share sale, the floor price for which has been set at Rs 365 apiece, is likely to fetch around Rs 450 crore.

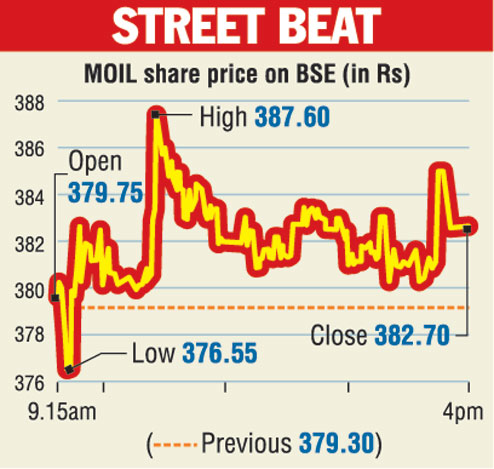

The floor price is at a discount of 4.63 per cent over the closing price of MOIL at Rs 382.70 on the BSE. Retail investors will get a further discount of 5.20 per cent in the offer for sale (OFS), an official said.

The government holds 75.58 per cent in MOIL, formerly known as Manganese Ore India Ltd.

"The government will divest a 10 per cent stake in MOIL tomorrow at a floor price of Rs 365 apiece," the official added.

Shares of MOIL closed at Rs 382.70, up 0.90 per cent over the previous close on the BSE today.

The two-day offer for sale will open for institutional bidding tomorrow and retail investors will be able to subscribe on January 25.

Earlier this fiscal, the government had raised about Rs 794 crore through the share buyback of MOIL.

The government has so far raised about Rs 30,000 crore this fiscal through minority share sale by way of OFS, share buybacks and CPSE exchange-traded funds (ETF).

Last week, the department of investment and public asset management (Dipam) launched the second tranche of CPSE ETFs, which was oversubscribed two times. The sale fetched Rs 6,000 crore to the exchequer.

Of the stake sale target for this fiscal, Rs 36,000 crore will come from minority stake sales in PSUs and Rs 20,500 crore from strategic sales.

Sources indicated that the government could meet the likely shortfall in revenue by buying back shares of some cash-rich PSUs and from dividends.