New Delhi, May 28: The government wants to list OVL, the overseas arm of ONGC, to help the company raise funds for foreign acquisitions.

"The disinvestment department has mooted the proposal of listing OVL and the oil ministry has forwarded the letter to ONGC for its comments," a senior company official said.

The official, however, said a listing did not seem appropriate at a time the company was keen to increase its assets. Moreover, OVL may not be able to fetch the right price given the current slump in global crude prices.

However, some other officials said a listing could help OVL meet its expansion and acquisition plans.

In its Perspective Plan 2030, ONGC has estimated that OVL's assets will produce 20 million tonnes of oil and oil equivalent gas by 2017 and 60 million tonnes by 2030. At present, these overseas properties produce about 9 million tonnes.

"To achieve this, the company is pursuing aggressive acquisitions of both exploration and producing assets and these kind of targets need several billion dollars, all of which cannot come from parent ONGC," the officials said.

Sources indicated that OVL's listing could come soon given the Narendra Modi government's keenness to reduce the oil import bill.

OVL's net profit for the 2014-15 financial year fell 57 per cent to Rs 1,904 crore over 2013-14.

"Despite higher production, the decrease in profit is mainly because of lower oil prices, higher financing costs, including exchange loss, higher depletion charge and impairment provision in one of the assets," the company said in a statement.

Global crude oil prices tumbled more than a half to $49 per barrel between June 2014 and January 2015.

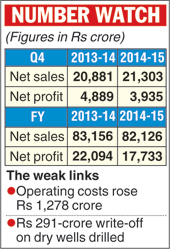

ONGC reported a 19.5 per cent drop in net profit at Rs 3,935 crore for the quarter ended March 2015, mainly because of higher operating costs and a write-off on dry wells drilled.

While the company realised $55.63 for every barrel of oil produced compared with $44.87 per barrel in the year-ago quarter, operating costs have risen by Rs 1,278 crore.