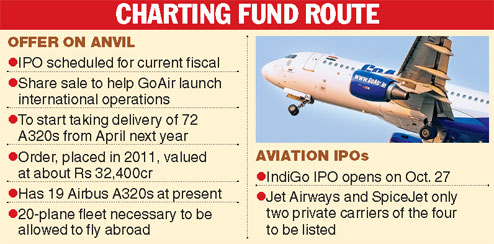

New Delhi, Oct. 18 (PTI): Wadia Group-promoted budget carrier GoAir is planning an initial public offering in the current fiscal, ahead of the scheduled delivery of 72 Airbus A-320 planes from April next year.

GoAir will be the second domestic carrier to come out with an IPO in the current fiscal after rival IndiGo, which is all set to raise a little over Rs 3,200-crore through an initial share sale on October 27.

As of now, only two private domestic carriers - Jet Airways and SpiceJet - of the four are listed.

GoAir is likely to file the preliminary papers for the share sale soon, the sources added. However, the likely size of the planned IPO could not be ascertained.

A GoAir official said, "We don't comment on market speculations."

GoAir and IndiGo are the only two profitable domestic carriers.

Sources said the share sale would help GoAir in its proposed international operations, which is at present on hold as it does not have 20 aircraft in its fleet, one of the two requisites for domestic carriers to fly abroad.

The carrier has only 19 Airbus A320s. It was scheduled to take the delivery of the 20th plane last year as part of its 20-aircraft order at the time of commencement of operations in November 2005.

The airline, however, deferred the plan in view of the commencement of the delivery of new Airbus A320 neo (new engine option) from April 2016.

In June 2011, GoAir had placed orders for these 72 new A320s, valued at about Rs 32,400 crore, with European aviation major Airbus.

The existing rules require domestic carriers to be in operation for at least five years and have a fleet of a minimum of 20 aircraft to be eligible to fly on international routes.

The rules are, however, under review as part of the much-awaited new civil aviation policy.

In signs of revival in the primary market, many companies are coming out with IPOs. Cafe Coffee Day Enterprises' Rs 1,150-crore share sale is the largest IPO in nearly three years.

IndiGo's Rs 3,268-crore IPO opens on October 27 and closes on October 29.

Though the carrier's share sale is much awaited, the expectations have been slightly tempered after the relatively lukewarm response to the Cafe Coffee Day issue.

Under IndiGo's offer, its parent InterGlobe Aviation will have fresh issue worth Rs 1,272.2 crore as well as an offer for sale of over 2.61 crore shares.