“Most of the stressed advances are on the corporate side. Some of the accounts (exposure of Rs 2,000 crore) are in advanced stages of resolution at the NCLT and the NCLAT. There is also the option of sale to ARCs and OTS. The bank will look to avoid slippages in retail lending,” said Sekar.

He added that the net NPA position of the bank is also expected to improve and the bank could be in a position to move out of the PCA framework on this count.

“The idea is to make the bank stronger even before amalgamation. We expect some improvement in the second half,” he said.

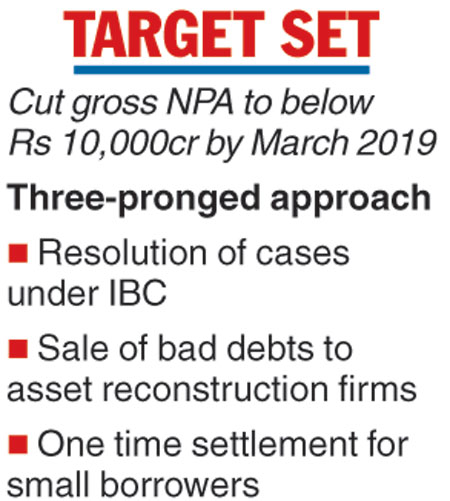

Public sector lender Dena Bank intends to bring down its gross non-performing assets to below Rs 10,000 crore by the end of March 2019 amid ongoing discussions on the amalgamation with Bank of Baroda and Vijaya Bank.

The gross NPA of the bank in the September quarter was over Rs 16,000 crore and the net non-performing assets were Rs 6,902 crore. The bank also hopes that the process of its valuation, as part of the merger, will be completed in the next three to four weeks.

“Our focus is to reduce the amount of non performing assets. We have set a target to bring it down below Rs 10,000 crore. The gross NPA ratio of the bank as of March 2018 was around 22 per cent. Our aspiration is to bring it down to 15 per cent by March 2019,” said Karnam Sekar, managing director and CEO of Dena Bank.

The lender is relying on a three-pronged approach to lower NPAs that includes resolution of cases under the Insolvency and Bankruptcy Code, sale of bad debts to asset reconstruction companies and one time settlement for small borrowers.

The Telegraph