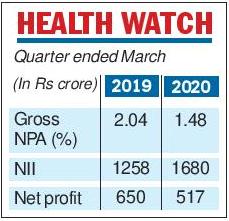

Bandhan Bank on Tuesday reported a 20.5 percent fall in net profit in the fourth quarter of 2019-20 to Rs 517.28 crore against Rs 650.87 crore in the same period last year because it made higher provisions on account of the potential Covid-19 impact on standard assets.

The bank with headquarters in the city said its provision of Rs 690 crore was higher than what is mandated by the RBI.

With this provision and additional standard assets provision that the bank is carrying in its micro banking portfolio, total additional provision in its books stands at Rs 1,000 crore.

Net interest income (NII) for the quarter grew 33.57 per cent to Rs 1,680 crore against Rs 1,258 crore in the corresponding period previous year.

Asset quality of the bank during the quarter improved as gross NPA (as a percentage of gross advances) declined to 1.48 per cent against 2.04 percent in the year ago period.

“The fourth quarter of the last fiscal has been a satisfying one given the challenges faced. During the quarter, the bank has showcased the strengths of its deposit franchise with continuously growing deposits in all the segments,' said Chandra Shekhar Ghosh, managing director and CEO of Bandhan Bank.

A large part of the bank's loan book is under the three-month moratorium. The bank said that 100 percent of its micro loan book and 13 percent of the mortgage loan book has opted for moratorium.

Among SME loans, 35 percent in value terms is under moratorium. However, 65 percent paid installments in April, the bank said.

Moreover, 59 percent of Micro Finance Institutions (NBFC MFI) loan book is under moratorium.

Total advances of the bank in the quarter grew by 60.46 percent to Rs 71,846 crore as against Rs 44,776 crore in the year ago period.

Total deposits increased by 32.04 percent to Rs 57,802 crore as on March 31, 2020 as compared to Rs 43,232 crore as on March 31, 2019.

Shares of Bandhan Bank ended 2.36 percent lower at Rs 233.95 on the BSE on Tuesday.