Insurance Regulatory and Development Authority of India (IRDAI) chairman Ajay Seth has flagged a key regulatory void in the health insurance ecosystem, pointing out the absence of oversight over health service providers and the resulting imbalance in their commercial relationship with insurers.

The IRDAI chief called for a need for a better structuring of contracts between insurance companies and health service providers.

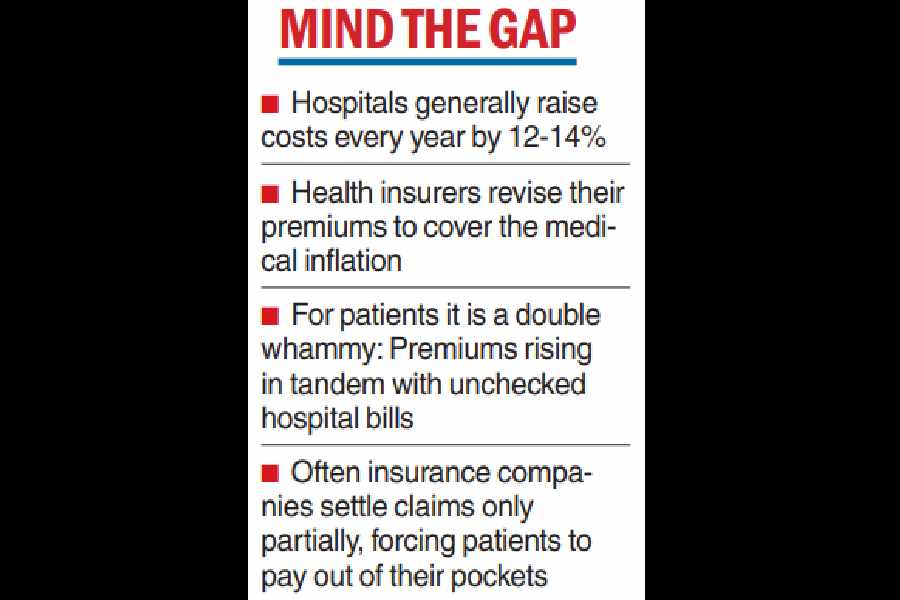

Seth’s observations come at a time when insurance companies and hospitals have been at odds over revision in hospital reimbursement rates. Typically, healthcare service providers raise costs every year by around 12-14 per cent and health insurance companies revise their premiums to cover the medical inflation.

Consumers of healthcare, patients and the family, are often found at the receiving end of this uneasy commercial relation between hospitals and insurers. There has been growing angst about premiums leapfrogging in tandem with unchecked hospital bills. Moreover, there have been instances of insurance companies settling claims only partially, forcing patients to pay out of pocket for treatments.

Speaking at an industry forum in Mumbai on Friday, Seth said that while insurance companies operate under a well-defined regulatory framework, hospitals and other healthcare service providers remain largely outside the ambit of regulation.

“The relationship between health insurers and health service providers is through commercial contracts, which are in need of better structuring and a better equilibrium,” he said.

Earlier in September, Association of Healthcare Providers — India, an industry body representing hospitals and health care institutions had advised its members in North India to stop providing cashless treatment facility to policyholders of Bajaj General Insurance after the insurance company had refused to revise hospital reimbursement rates.

This had prompted the General Insurance Council, the industry body for general and health insurance companies, to publicly denounce the move from the AHPI.

“This (regulatory gap) has been a consistent cause of concern for many years and it often leads to disputes and inefficiencies. We hope that there is a harmonised regulatory approach in future that ensures transparency for the policyholders and insurers,” an insurance industry executive said.

Industry sources said that following recent discussions between hospital and insurance representatives, hospital costs in 2026 are unlikely to see a major spike. This comes at a time when insurers have a tough task to manage costs after health insurance has been exempted from GST for individual polices, but without input tax credit available for insurance companies.

Climate risk

Amid rising instances of climate related risks, particularly for the insurance sector, Seth also said that regulators and the government should work together to develop a comprehensive and consistent framework to identify, assess and monitor systemic climate financial risk.

“The objective should be to ensure that effective management of climate related risks and opportunities should promote long term financial stability without compromising on the nation’s development aspirations and priorities,” he said.

The IRDAI chairman also emphasised the need to amplify the voice of policyholders in the regulatory process, saying that their expectations — both current and potential — should be incorporated in a “more structured and extensive manner”.