The Centre’s decision to issue 50-year bonds for the first time is designed to satisfy the demand from insurers and provident funds for government securities that assure safety and yield high returns. They are expected to participate in a big way at the auctions for the long-dated bonds that will take place at the end of this month.

On Tuesday, the Centre announced it would borrow Rs 6.55 lakh crore in the second half of this fiscal out of total gross market borrowing of Rs 15.43 lakh crore projected for 2023-24 in dated securities.

While they will be spread over 20 weekly auctions, government securities worth Rs 30,000 crore, or 4.58 per cent of the target, will have a tenure of 50 years.

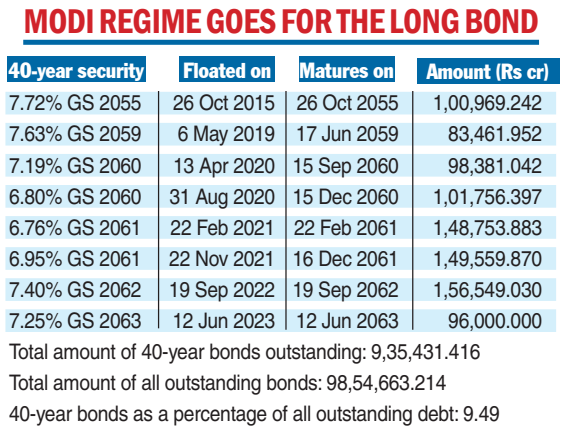

The half-century security will be added to other long-dated ones such as 30 years and 40 years. The first 40-year bond was auctioned by the Reserve Bank of India (RBI) in October 2015. Before that, the 30-year bond was the longest-duration security issued by the government.

According to the issuance calendar announced by the RBI, the sum of Rs 30,000 crore to be raised from 50-year G-Secs will be raised in three auctions: October 30-November 3, December 11-15 and January 22-26, 2024.

At a very simplistic level, a 50-year bond means the repayment burden falls on our grandchildren.

Market circles said it has been launched to meet the demand from insurance and pension funds. "The life insurance sector may be interested in ultra-long tenure bonds to manage their ALM (asset and liability management) profile,’’ Aditi Nayar, chief economist, Icra, said.

Gaura Sengupta, economist at IDFC First Bank, said the size of the auctions is in the range of Rs 30,000-39,000 crore per week, similar to the average size of Rs 31,000-39,000 crore in the first half of the fiscal.

However, the borrowing calendar in the second half is slightly more concentrated in ultra-long bonds (30 years to 50 years) at 35 per cent compared with 34 per cent in April-September spread across 30-40 years.

She said the expansion of the formal sector is a factor behind the launch of the 50-year bond, with households allocating a higher share of financial savings in life insurance, pensions and provident funds.

Gupta expects India’s inclusion into JP Morgan’s emerging market bond index from the next year will keep G-sec yield capped, countering upward pressure from elevated crude oil prices and higher US treasury yields.

“Domestically, net G-sec and SDL (state development loans) supply will be lower in the second half 2023-24 at Rs 7.9 trillion versus Rs 9.9 trillion in the first half. Investor demand tends to pick up in the second half of the financial year. Moreover, in case inclusion into Bloomberg Global Aggregate Index is announced 10-year yield could fall below 7 per cent by March 2024,’’ she said.