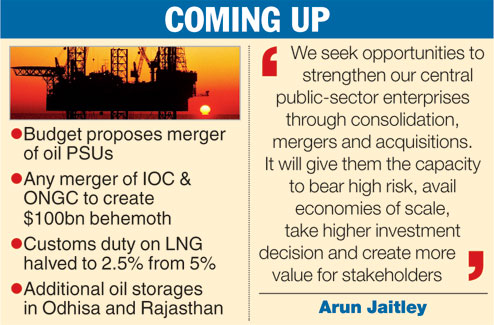

New Delhi, Feb. 1: The government has proposed the merger of state owned oil firms like ONGC and IOC and others to create a behemoth that could top $100 billion in valuation and match global companies in financial heft and enable them to have bigger resources and appetite for acquisition.

"We seek opportunities to strengthen our central public-sector enterprises through consolidation, mergers and acquisitions. It will give them the capacity to bear high risk, avail economies of scale, take higher investment decision and create more value for stakeholders," finance minister Arun Jaitley said in Parliament while presenting the budget.

The upstream production is dominated by ONGC and the biggest refiner is IOC. BPCL and HPCL are the two other state-owned refiners, while Oil India Ltd is a smaller oil and gas producer. GAIL India Ltd is the country's largest gas pipeline operator.

"Creating an integrated oil major will help achieve the goal of increasing India's energy security...A bigger entity will have bigger resources and a bigger appetite for acquisitions," ONGC chairman Dinesh Kumar Sarraf.

The move seems to be following the footsteps of China, which has indicated its intentions to merge Sinochem Group and China National Chemical Corp, to create an oil giant.

R.S. Sharma, former managing director of ONGC, said consolidation of all upstream, midstream and downstream oil companies in the country "will be a game changer."

A consolidated entity could rival the likes of Russian state oil giant Rosneft ($55 billion market-cap) and UK's BP Plc ($110 billion m-cap) in market value and financial power. The top eight listed Indian state oil firms have a market value of $108 billion, much higher than the $70 billion of Russian state oil giant Rosneft and close to the $115 billion of UK's BP.

"An interesting announcement has been the creation of integrated PSU oil major, this could lead to consolidation of existing oil PSUs and possibly look at international markets for funding and/or possibility of leveraging on larger balance sheet for bidding for upstream assets, given India's thirst for oil," Mukesh Butani, managing partner, BMR Legal said.

The finance minister has reiterated the proposal mooted in last August to enable the merger of state owned oil firms for energy security. Oil minister Dharmendra Pradhan had then said: "It is an idea which was reportedly mooted by a director of a state-owned company and, like all ideas, have to be debated; we are debating it."

Incidentally, a similar proposal was considered more than a decade ago, but was set aside when a committee that studied the matter said such a merger might not be feasible.