New Delhi, May 4: Kishore Biyani-led Future Group today agreed to merge its retail business with rival Bharti Retail in an all-stock deal worth Rs 750 crore to create one of the biggest supermarket chains with a turnover of Rs 15,000 crore.

This is the second major consolidation exercise within two days in the fast-growing Indian retail sector after Aditya Birla Group yesterday announced merging all its apparel retail businesses into a single entity.

The two-tier deal between the Future and Bharti groups also involves the merger of their respective retail infrastructure businesses - creating two separate companies, Future Retail for the front-end activities and Future Enterprises for infrastructure.

Future Group promoters would hold a 46-47 per cent stake in each of the two companies, while Bharti Retail will have about 15 per cent holding in each of them.

As part of the deal, Bharti Retail will get shares worth Rs 500 crore immediately, while shares worth another Rs 250 crore will be converted at a later date.

"We are merging our retail businesses to create two separate companies ... The combined retail entity will have a total turnover of Rs 15,000 crore," Future Group CEO Kishore Biyani told reporters here.

Bharti's Easyday chain of stores and Future's Big Bazaar stores will continue to operate, Biyani said.

Bharti will have one member on the board of each of the two new companies. The new retail entity will have one of the larger networks in India with 570 stores across 243 cities.

Reliance Retail, which clocked a turnover of Rs 17,640 crore in 2014-15, has 2,621 stores across various formats in the country.

Stating that Bharti was not exiting its retail business, Bharti Enterprise vice-chairman Rajan Bharti Mittal said: "We are only merging. This was needed for faster growth. It is a strategic fit for both the companies."

Earlier in 2013, Bharti and global giant Walmart had terminated their partnership, including a franchise agreement in the retail business, after which the US-based retailer acquired full control of their wholesale cash-and-carry business joint venture.

While policy allows for 51 per cent FDI in the multi-brand retail sector, the foreign retailers have been cold to set up shops in India because of political backlash.

The Future-Bharti deal comes a day after Birla Group merged its apparel businesses into a Rs 5,290-crore entity named Aditya Birla Fashion and Retail, which will be the largest pure-play fashion lifestyle company in India.

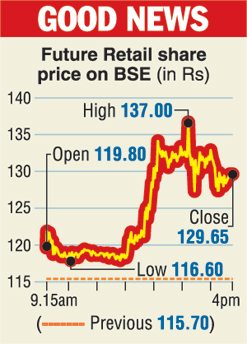

Following the announcement, Future Retail shares soared 12.06 per cent to close at Rs 129.65 on the BSE.

Shares of the two listed Birla group firms also rose higher today.

Although Bharti Retail has zero debts, the new combined retail entity will have Rs 1,200-crore debt, while the combined infrastructure company will have a Rs 3,500-crore debt.

New stores

Biyani said the group plans to open 4,000 smaller format stores by 2021, up from 570 stores now.

All the new small format stores in North India will be opened under the Easyday brand. In south and west India, the stores will be opened under Nilgiri and KB's brand.

Bharti Group has been looking out for partners for a full-fledged retail play after parting ways with Walmart in 2013.

Bharti Retail runs over 210 Easyday stores across different formats in India, mostly concentrated in the northern region.

Future Group also has been making a move to consolidate its business after selling a majority stake in Pantaloons to Aditya Birla Retail in 2012. It has different formats, including hypermarkets under Big Bazaar and supermarkets under the Food Bazaar brand.

Biyani said the merger between Future and Bharti Retail is a win-win situation.

"There is no overlap in our stores presence. We did not have the smaller format stores that Bharti Retail has," he said, adding the combined entity would have a total of 18.5 million sq ft of retail space.

Share swap

As part of the deal, Bharti Retail will issue one equity share of Rs 2 each for every share of Rs 2 held in Future Retail in consideration of the merger of Future's retail business into it.

On the other hand, Future Retail will issue one fully paid up equity share of Rs 2 each to Bharti Retail shareholders for every share of Rs 2 held in it in relation to the merger of the retail infrastructure business.

The Bharti Retail shares issued to shareholders of Future Retail will be listed on bourses. As part of the deal agreed between the two firms, Bharti Retail's existing holders of optionally convertible debentures aggregating Rs 250 crore will hold OCDs in Bharti Retail as well as Future Retail aggregating to the same amount.