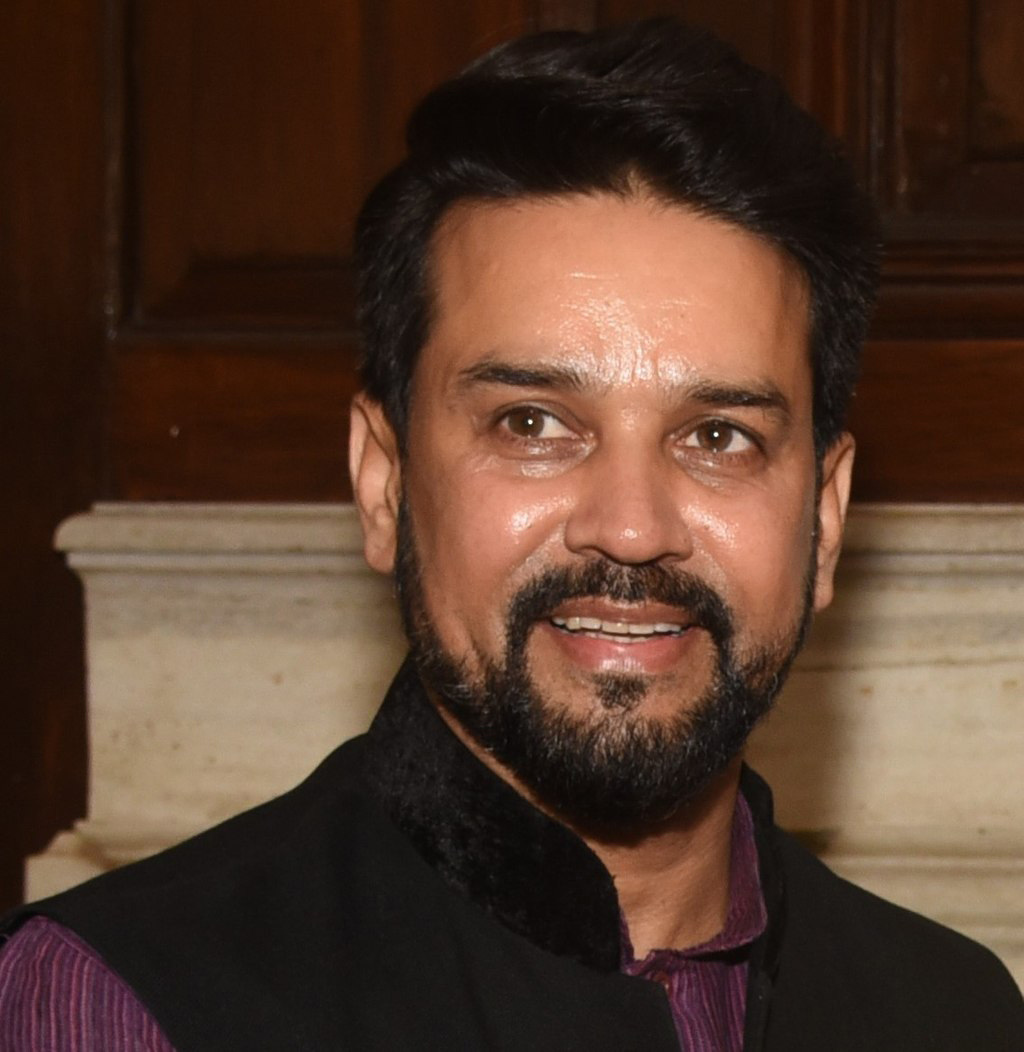

No bank has the power to employ bouncers for the forceful recovery of loans from customers, junior finance minister Anurag Thakur said in the Lok Sabha on Monday.

He added that the Reserve Bank of India (RBI) has issued a directive to appoint recovery agents only after proper police verification and fulfilling other relevant formalities.

“No one has any power to appoint any musclemen or bouncers for the recovery of loans forcefully,” he said during the question hour.

Thakur said the RBI has issued Guidelines on Fair Practices Code for Lenders. The guidelines are required to be adopted by banks, duly approved by their boards.

“The said circular prohibits lenders from resorting to undue harassment in recovering loans, viz., persistently bothering borrowers at odd hours, use of muscle power for recovery of loans, etc.,” he said.

The minister said with regard to complaints, the RBI has informed that complaints received by it regarding violation of the guidelines and abusive practices followed by banks’ recovery agents are viewed seriously.

“In such cases, the RBI can consider banning the bank concerned from engaging recovery agents in a particular area for a specified period.

“In case of persistent breach of above guidelines, the RBI can also consider extending the period or the area where the bank concerned is barred from engaging recovery agents,” he said.