The Narendra Modi government seems to have taken a battering ram to economic policy-making while hardening its resolve to retaliate against China for slaughtering 20 ‘unarmed’ Indian soldiers in Ladakh. The Centre is clearly being jolted into action by a rising clamour from hotheads within and outside the establishment to punish Beijing by boycotting Chinese products. This is easier said than done. China is one of India’s biggest trading partners and many businesses in India depend on the supply of goods and services and the flow of credit from China to keep their factories running. In the absence of alternatives, any policy amendment that targets Beijing by erecting tariff and non-tariff barriers will only undermine India’s economic interests.

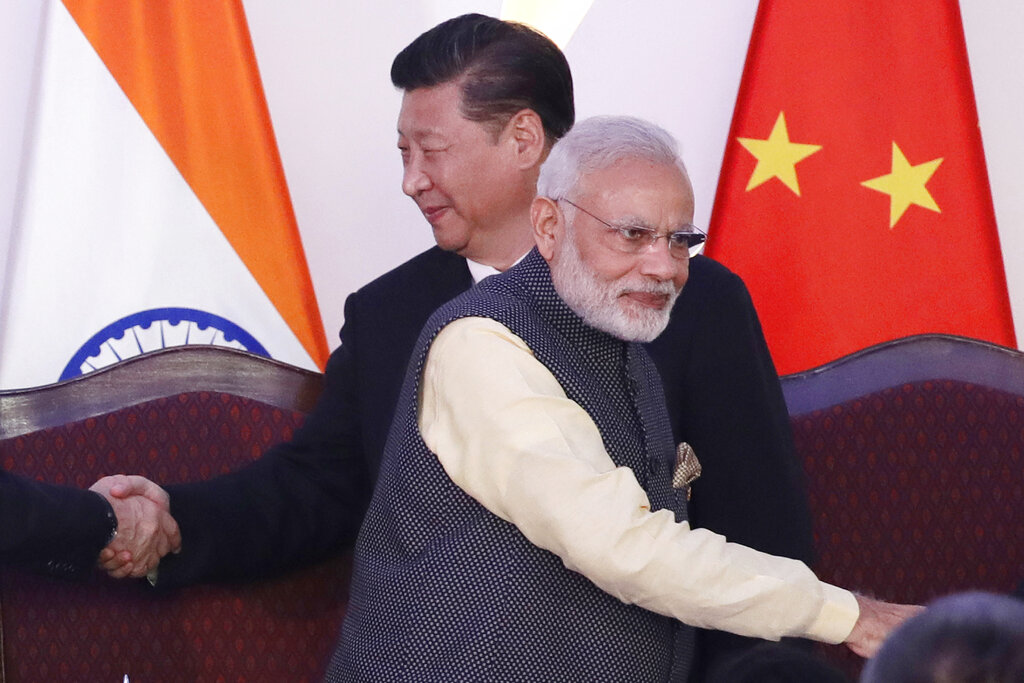

Reports suggest that the Centre is reviewing its options and that the strictures it comes up with will severely circumscribe the extent of the Sino-Indian economic ties. China has a massive trade surplus with India, amounting to over $48 billion in 2019-20. The government intends to chip away at this surplus by raising duties on a host of products that Indian businesses source from China. In April, the Centre had changed the foreign direct investment policy by deciding to subject equity fund flows from nations sharing a border with India to close scrutiny: this was a thinly-disguised attempt to stop China from grabbing control of stressed Indian companies whose valuations had been gouged by the pandemic. But after the skirmish in the Galwan Valley, the gloves are off.

The shoguns in industry have already started to voice concerns that the Centre may adopt measures that can scupper any chance of recovery in the manufacturing sector while clawing out the prospects of the services sector in areas like telecommunications. The Bharat Sanchar Nigam Limited has already been directed to rethink plans to secure telecom equipment from China when it upgrades its network. The axe is also likely to fall on a telecom equipment vendor like Huawei, which has been allowed to participate in the 5G trials in India. More than 100 Chinese companies are involved in infrastructure projects in India and any attempt to stop imports will wreck completion schedules with no recourse to force majeure reliefs. The start-ups in the technology sector have all raised money from Alibaba and Tencent Holdings and their future could turn horribly bleak if they cannot rustle up investors in the next round of funding. Indian companies operating in China — especially those in the technology sector like Infosys and TCS — and carmakers like the Tata-owned Jaguar Land Rover could face retaliation if India decides to pull the trigger. The grim truth is that India accounts for less than 2 per cent of exports out of China. So a ban on Chinese products will not hurt Beijing. India, however, sources close to 14 per cent of all its imports from China. And then there is Hong Kong — the staging post for all investors who wish to do business with mainland China. Any attempt to snare the dragon will also queer the pitch for Indian businessmen who have operated out of the Chinese enclave for decades.