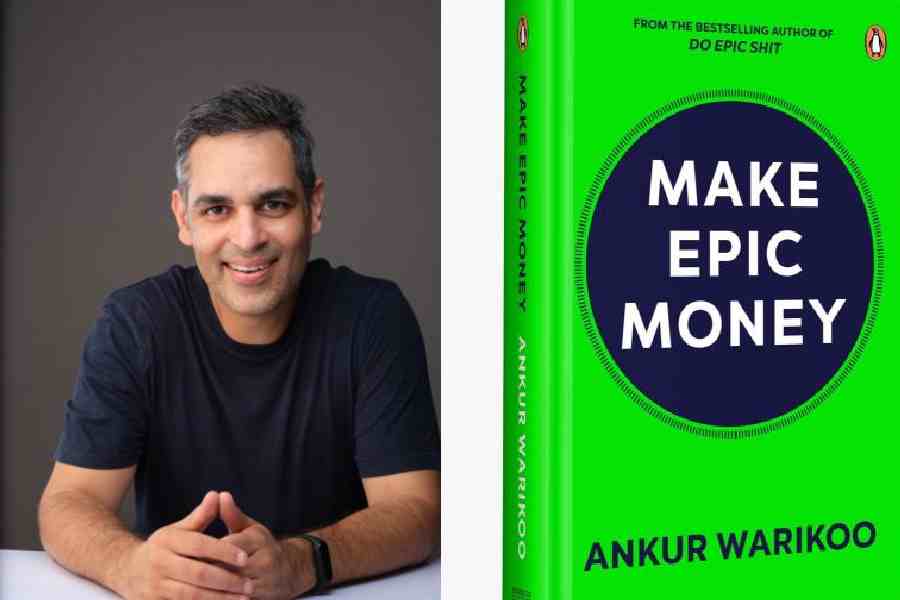

Entrepreneur, content creator and author Ankur Warikoo is widely known for his deep, witty and brutally honest thoughts on success and failure. With his latest book Make Epic Money essentially breaking down financial concepts for what the author calls the ‘Instagram generation’, Warikoo strives to empower individuals to achieve financial success and personal growth in a way that is both engaging as well as relatable. A t2 chat.

What inspired you to write Make Epic Money?

The fact that no one at school, college, or even my parents, taught me anything about money. All that I was taught was how to earn a living. So, I ended up making a lot of mistakes before I realised how money could work for me. This book is written for the 20-year-old me, sharing all the things that I wish I was told about money.

To the uninitiated, traditional books on money often come across as boring or intimidating. What makes Make Epic Money differ from these conventional finance books?

There are three things: One, it is not written by an expert, so it doesn’t talk down to the reader. Second, it is written in a very simple manner — no jargon or slang. And third, it is written for the ‘Instagram generation’ so it reads vertically as against horizontally. There are no heavy paragraphs or long sentences.

Can you share a specific experience or realisation that prompted you to believe that there was a need for a different approach to teaching the masses about money?

Make Epic Money is the result of my own experiences. The fact that I went to the finest schools, was surrounded by super sharp minds, had access to the best knowledge, and despite all of that was so poor in managing my money. For most without the privilege I had, money becomes this thing of mystery and desire.

In the process of writing the book, what key principles or lessons did you find most important to convey to your readers?

There are three key lessons. First, the best way to get rich is to get rich slowly. Second, if you do not build the habit of saving with a low salary, you will never be able to save even with a big one. Third, one doesn’t have to give up on living life today in order to build a wealthy life tomorrow.

Considering your own journey, what are some of the financial lessons you wish you had learned earlier in life, and how does this book address those gaps?

There are a few. To list some: How to start investing early? Because I knew how to make money easily, I never paid attention to how to manage this money well. Also, how to not invest out of FOMO. I made a lot of investments driven by people around me and what they were doing. Lastly, how to understand compounding. I was in a hurry to make money. Patiently growing my money was for fools, or so I thought!

What do you hope readers will take away from Make Epic Money, especially those who may have found traditional finance literature unappealing?

Just one — that there is space for everyone to make money. Money is not a zero-sum game where someone has to get poor for someone else to become rich.

Is this a book for entrepreneurs?

This is a book for anyone who has had a complicated relationship with money so far and wishes to fix it.

What’s next?

A book a year. The next one will be on careers.