Vodafone Idea has received crucial breathing space after the government, now a 49 per cent shareholder in the debt-laden telecom operator, set out a staggered payment framework for past adjusted gross revenue (AGR) dues that eases near-term cash outflows.

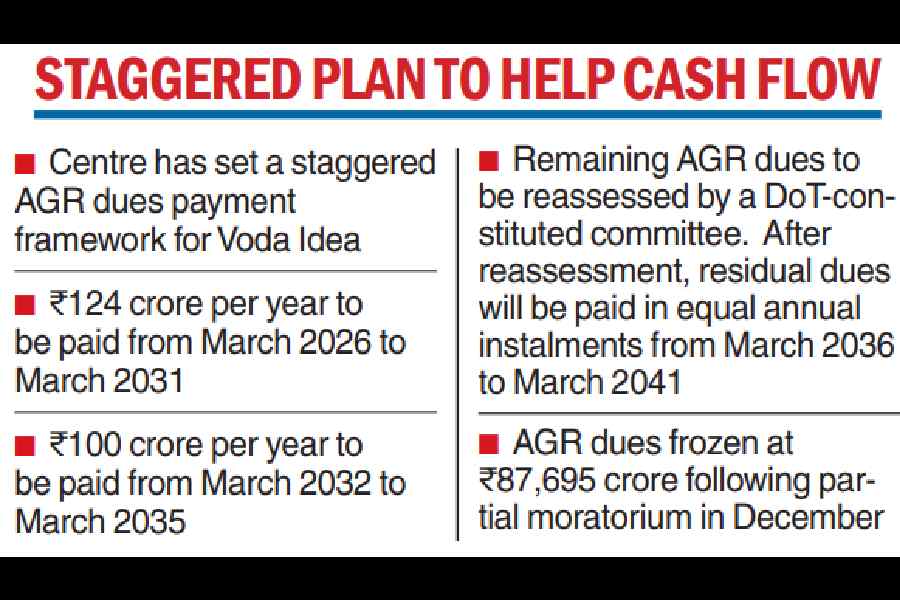

According to a communication from the Department of Telecommunications (DoT), cited in a stock exchange filing by the company, annual payouts have been capped at ₹124 crore between March 2026 and March 2031. For the subsequent four years, from March 2032 to March 2035, the yearly liability will be pared to ₹100 crore.

Thereafter, the residual AGR dues will be paid in equal instalments over six years between March 2036 and March 2041 after reassessment by a DoT-constituted committee, whose decision will be final, the filing noted.

Under the notified schedule, Vodafone Idea will pay ₹1,144 crore to the government over the coming decade, with scope for reassessment of the remaining dues.

The move follows the Centre’s December 31 approval of a partial moratorium that froze total AGR-linked liabilities at ₹87,695 crore, after the Supreme Court observed that reconsideration of AGR issues lay within the executive’s policy domain.

The payment schedule announcement on Friday sent Vodafone Idea shares higher by 9 per cent in morning trade, but the stock pared most of its gains by afternoon as analysts remained cautious about upcoming funding needs to support its 5G expansion plans. The stock closed at ₹11.27, down 2 per cent, on the BSE.

The structured, phased payouts mark a significant improvement from the earlier scenario, under which the operator would have faced cash demands of around ₹18,000 crore by March 2026 and similar amounts annually for subsequent years in the absence of a relief.

Vodafone Idea has previously informed the DoT that its overall liabilities to the government are close to ₹2 lakh crore, including ₹1.19 lakh crore of spectrum-related dues.

The relief measure is aimed at protecting the interests of the government and enabling orderly payment of dues to the Centre by way of spectrum auction charges and AGR dues, while ensuring competition in the sector and safeguarding the interests of 20 crore consumers of the telecom operator.

Analysts expect that the reassessment is likely to reduce Vodafone Idea’s AGR dues, and the relief given by the government may help it raise around ₹25,000 crore debt that the company has been looking for as investment to expand its network.

“In our view, this could fast-track the completion of Vi’s ₹250-billion (₹25,000 crore) bank debt raise and potentially enable another equity raise down the line. Besides meaningfully lifting concerns on Vi’s ability to service government dues and, therefore, on its ability to continue as a going concern, these should also enable the company to revive its network investments,” a Citi report said.

An Ambit Capital report said decisive government action with possible upside from reassessment would enable Vi to raise bank funding necessary for carrying out survival capex. The report said a favourable verdict from the Supreme Court has already enabled the telecom firm to raise ₹3,300 crore through non-convertible debentures recently.