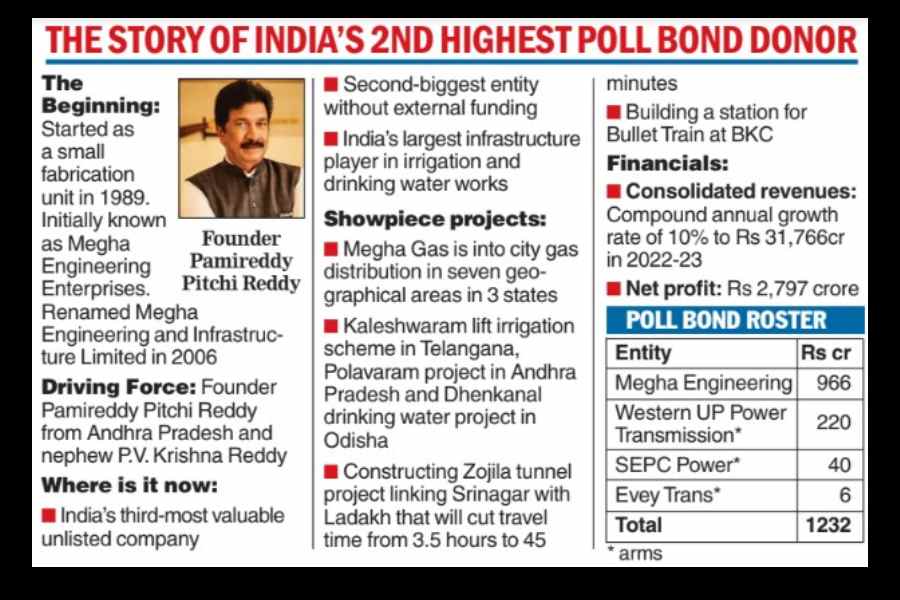

From humble beginnings as a small fabrication unit in 1989 to the second-largest purchaser of electoral bonds is not the only standout feature of this privately-held company based in Hyderabad.

Megha Engineering and Infrastructure Ltd (MEIL) is also India’s third most valuable unlisted company and second biggest bootstrapped entity — which means it relied on internal resources and didn’t tap any external funding.

It is also the largest EPC (engineering, procurement & construction) player in irrigation and drinking water works in the country.

Data submitted by the State Bank of India to the Election Commission of India showed MEIL made donations worth Rs 966 crore between April 2019 and October 2023.

If one were to include group firms such as Western UP Power Transmission Company, SEPC Power and Evey Trans Pvt Ltd, donations stood at Rs 1,232 crore, after Future Gaming which gave Rs 1,368 crore.

MEIL was founded by Pamireddy Pitchi Reddy, who came from an agrarian family.

Initially known as Megha Engineering Enterprises (MEE), the company’s growth gathered pace after Pitchi Reddy’s nephew P.V. Krishna Reddy joined after two years.

MEE set up drinking water and irrigation projects in the mid-1990s in then undivided Andhra Pradesh and later ventured into other states in the 2000s. It was renamed as MEIL in 2006.

From irrigation and drinking water, the group ventured into big projects in areas of power plants, railways, road & highway projects, oil & gas pipelines, large water treatment plants, manufacturing and supply of drilling and workover rigs for onshore and offshore applications, city gas distribution (CGD) and electric buses.

MEIL arm Mega Gas was set up in 2015 and it launched its maiden CGD activities in Andhra Pradesh’s Krishna district, Karnataka’s Belgaum and Tumkur. It later expanded to Telangana’s Nalgonda, Rangareddy, Khammam and Warangal districts.

Megha Gas began its services in 7 geographical areas (GAs), reaching 16 districts across three states. According to the company’s website, it is now expanding its service network to 10 states.

In 2018, MEIL ventured into the media business, when it led a group of investors to acquire Associated Broadcasting Company Pvt Ltd (ABCL), which owned regional television news channels under the brand TV9.

The transaction was reportedly executed by the MEIL promoters, My Home Group and other investors who acquired 100 per cent of ABCL for over Rs 450 crore. (This newspaper is part of ABP Group, which owns TV channels and competes with TV9 in some regions.)

Some of the key projects that have been associated with Megha Engineering include the Kaleshwaram Lift Irrigation Scheme in Telangana and the Polavaram project in Andhra Pradesh, which was awarded in a reverse tendering process done by the state government.

The Zojila Tunnel project which will provide all-weather connectivity between Srinagar and Leh is another showpiece project. Being executed for the National Highway and Infrastructure Development Corporation Ltd under the EPC mode, the tunnel will cut the travel time Srinagar and Leh to 45 minutes

from 3.5 hours.

Megha has also bagged a Rs 3,681-crore project for the construction of a bullet train station at the Bandra Kurla Complex (BKC) in Mumbai.

Observers said strong project execution capabilities are one of the main strengths of the group.

Moreover, it has diversified itself geographically in India and ventured overseas, bringing down its over-dependence on Andhra Pradesh and Telangana.

The group’s listed entity is Olectra Greentech, which makes electric buses in collaboration with China’s BYD

According to Crisil, which rated the company’s commercial paper in January, MEIL’s consolidated revenue has grown at a five-year CAGR (compounded annual growth rate) of 10 per cent to Rs 31,766 crore in fiscal 2022-23. It stood at Rs 28,849 crore in 2021-22.

During these two years, net profit of the company rose to Rs 2,797 crore from Rs 2,601 crore.

The rating agency said the majority of the outstanding orders of MEIL are from domestic projects.

The share of projects from Andhra Pradesh and Telangana has declined to 40 per cent in the current fiscal from around 70 per cent in the earlier years.

Crisil estimates MEIL’s net worth will be Rs 24,400 crore as of March 31, 2024, and this will improve to over Rs 26,000 crore in 2024-25.